Millennial men aged 18-34 are the most aware and interested in subscribing directly to TV channel apps. These apps allow viewers to subscribe directly to a TV network without also requiring a subscription to a cable or satellite channel bundle.

According to The NPD Group Connected Intelligence Great Unbundling of Pay TV Report, 62 percent of men 18-34 years old are aware of the currently available or announced over-the-top TV Network apps. Of those 18-34 year old males who are aware, 60 percent are extremely or very interested in direct subscriptions to one or more of those apps. The awareness and interest among this important viewer segment is significantly higher than the general population.

“Millennials’ viewing habits differ from prior generations. While many will continue to subscribe to cable and satellite TV, the growing popularity of streaming services is undeniable,” said John Buffone, executive director, Connected Intelligence. ”Un-authenticated network apps offer a new way to encourage younger viewers to tune-in. This increases networks’ audience reach and offers operators an opportunity to bundle attractive TV channels with their broadband services.”

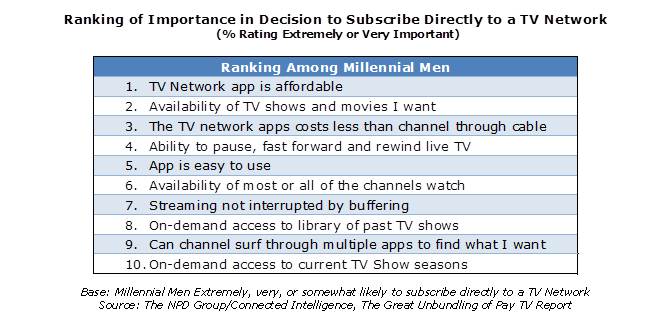

These network apps, however, need to be affordable, reliable, and easy to use. Among Millennial men who are at least somewhat likely to subscribe to a TV Network app outside of their pay TV subscription, cost is cited as two of the top three deciding factors. These apps also need to be easy to use and have a full array of content for viewing.

“As more networks launch un-authenticated apps, viewer’s time spent watching TV will include more streaming hours,” added Buffone. “Viewers’ interested in network apps are cost-conscious and content hungry which will make it challenging to find the optimal balance between affordable rates and delivery of premium content and in-app features. Ultimately, distribution through un-authenticated networks apps is a positive step towards keeping Millennials plugged into prime time content.”

Methodology

Great Unbundling of Pay TV Report

2,888 U.S. consumers age 18 and older were surveyed in January 2015. Qualified survey respondents indicated they make or influence household decisions around TV subscriptions. Awareness reporting is based on those that indicated knowing that WWE, HBO, Showtime, or CBS have begun to offer (or have announced plans to offer) direct subscriptions to their programming without requiring a pay TV subscription from a cable or satellite provider.