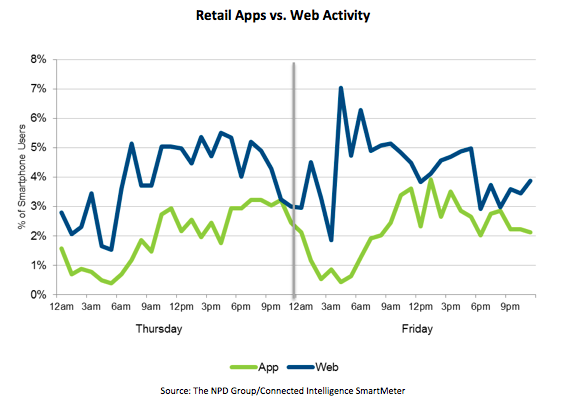

The post-Turkey shopping extravaganza saw a significant increase in smartphone use, with some services seeing almost double the use of last year. But the real winner was less an individual retailer and more the overall web platform versus individual retailer apps. As we discovered in the recent Shopping on Smartphones report, many consumers continue to use the retailer websites, not the made-for-shopping apps that all the major retailers have developed.

There are several key reasons for this continued reliance on websites, versus apps. First and foremost is the flexibility that comes with websites: all phones support multiple open browser windows and easy bookmarking, allowing consumers to plan ahead a little, listing the most-wanted items. Further, the website is familiar, as it is the same site that is used on the PC and tablet. But the most fundamental reason is that retailer apps often fail to deliver key additional services that would make them must-have solutions for the time-is-lost-bargains Black Friday event.

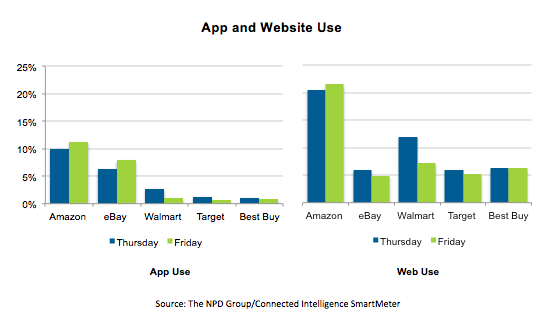

But while the relative loser is the app category, the retailers all enjoyed a significant upswing in overall traffic compared to last year, signaling that the smartphone has become well and truly embedded as part of the bargain shopping experience. All of the retailers saw at least double the smartphone use from last year on the websites for Friday alone. Considering that the shopping experience has now become a day-and-a-half experience, the reality is that overall consumer penetration of smartphone shopping was greater than double. Thursday was particularly active, as consumers prepared for the initial onslaught.

Overall use of the apps and websites (particularly the latter) was more consistent than last year; caused primarily by many retailers staggering their Black Friday bargains over a longer period, which drove a continued consumer engagement. Last year, smartphone use essentially disappeared once the store doors opened, and slowly built up again during the day. This year the web in particular continued to drive engagement.

Of course, there is one key caveat in the “retailers win” comment above: while all the brick and mortar retailers enjoyed a major boost in related smartphone use, so too did Amazon. The online only retailer saw an increase from 13 percent reach (percentage of the smartphone base) to 21.5 percent for its website. Notably, Amazon was the only retailer to see a significant increase in app use, up from 9.5 percent reach last year to just over 11 percent this year.

Searching for Greater Bargains

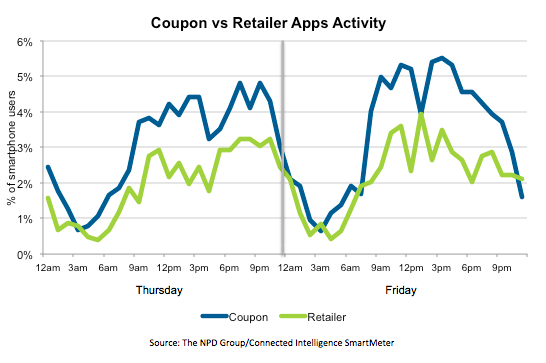

Coupon and related apps, such as Groupon, also saw some strong use, with more than 23 percent of the smartphone base leveraging these apps during the two-day period. The apps use continues to skew primarily female, with nearly 30 percent of the female base using one or more of the apps, compared to 18 percent male.

Coupon app use is significantly higher than retail apps, but again this is to be expected. A consumer really only needs to embrace one specific couponing app to serve most, if not all, of their needs. As a result, it is convenient to use a couponing app, compared to retail apps where a consumer needs to use specific apps per store.

Mass Merchant and Electronic Rule The Day

When it comes to smartphone shopping activity, the mass merchant and big box electronic sites and apps accounted for the vast majority of traffic. Indeed, beyond the top five stores (Amazon, eBay, Walmart, Best Buy and Target) consumer use significantly dropped off. To an extent, this is unsurprising: these stores drive a lot of the Black Friday shopping activity, particularly for bargain electronics such as TVs and such. However, the large retail chains, while doing better than last year, have a long way to go in driving smartphone use as part of the shopping experience.

This is somewhat contrary to what consumers expect to shop for with their smartphones: 73 percent of smartphone owners cite clothing, shoes and jewelry as a key category for smartphone-related shopping, according to the Connected Intelligence Shopping on Smartphones report. Of course, Black Friday is somewhat an anomaly when it comes to shopping: many consumers will have planned ahead, particularly for clothing items and this could negate the need to pull out the phone in the midst of the shopping rush. However, the fact remains that the smartphone is under-utilized in many categories beyond electronics at this time.