Google and Apple have taken clearly different approaches to the smartphone market overall. On the one hand, Apple approaches the market from a hardware-centric perspective (after all, Apple fundamentally sells hardware), while Google outsources the hardware component, focusing instead on the content delivered by the hardware and related search and advertising opportunities. At the center of these two approaches are the smartphone-toting Connected Consumers who leverage the ecosystems, but there are clear differences between iOS and Android Connected Consumers when it comes to a wider brand loyalty beyond the device itself.

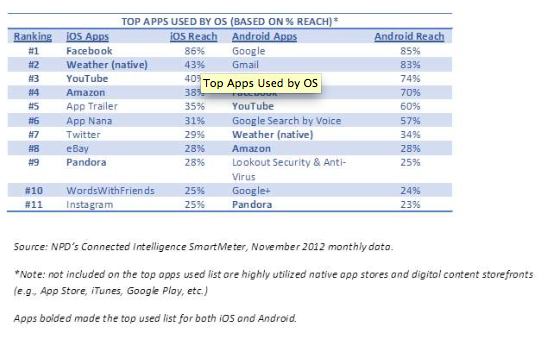

Based on NPD Connected Intelligence’s SmartMeter, November 2012 monthly data, for both iPhone and Android smartphone users there are a core five (or six if we include email or Gmail) needs fulfilled by apps, including: social (Facebook), weather (native app), video (YouTube), shopping (Amazon) and music (Pandora) (see table below). We’ve included the top eleven apps, as – weather – while critical, leverages the native weather app on the device. (Note: not included in the iOS top list is the use of the native mail client, which is used by 94 percent of users, with the vast majority likely accessing Gmail.)

What’s also striking in looking at this top list for Android users, is that roughly half (including YouTube) are Google-owned/branded experiences. Further, while not showing up in this top 11 list, but ranking 12th among Android smartphone users is another Google experience – Google Music (and ranking just behind Pandora at a 22.8 percent reach). This does not mean that iOS users are not accessing Google apps and experiences that are available, including Gmail (as email accounts are set-up in the iOS native mail application, utilized by 94 percent of iPhone users, and vast majority are likely using Gmail), or Google Search (which is the 12th most used app – just behind Instagram at 24 percent). It’s just that for Android users Google experiences may be better and/or surfaced for the user. It’s also important to note that the higher usage of YouTube among Android users versus iOS users may in part be attributed to the fact that iOS 6 excluded YouTube, which means that iOS users need to pull the app to the device (versus previous software releases which pre-loaded YouTube on the device). Further, the iOS 6 Apple Maps debacle, and subsequent launch of Google Maps for iOS (in December 2012), still does not equate to parity in Google service experiences cross-OS, and may continue to impact usage as well.

All-in-all, isn’t the extension and high utilization of Google branded experiences on mobile devices what Google intended with Android?

Overall, the data is instructive (for service providers, device manufacturers, content owners, publishers, application developers, advertisers and others) to track how Android and iPhone smartphone users are spending their time in different app experiences on their devices.