While I never thought I’d ask “why did the power go out?” during the Super Bowl, I did have a number of questions going into the Big Game, including: 1) Which Brother Harbaugh will prevail? 2) Will Beyoncé redeem herself from “lip-sync-gate”? 3) How will consumers’ use their smartphones (companion, second screen) on Game Day? Well: These were the big questions that I was pondering, and for which I now have answers for: 1) John Harbaugh, 2) Yes, and 3) smartphone users kept their eyes affixed to the Big Screen, and periodically leveraged the immediacy and utility of their second-screens.

The Connected Intelligence SmartMeter found that consumers were using their smartphones to communicate, socialize, and get information – not just on the game itself, but on the advertising, and in some instances viewing the ads again on their second screens. Because for many of us that are fans of teams not in it (i.e., the New England Patriots, “cough, cough”), it’s more about the advertising than the actual game.

Advertising mobile calls-to-action focused less on directing consumers to download or engage in branded and/or second screen app experiences, and focused more on integrating advertising with social media, mostly twitter. This is a stark contrast to last year’s Super Bowl when Shazam heavily marketed its second-screen “Shazam for TV” audio-tagging capabilities for advertising and half-time show content with its blanketed TV to mobile calls to action. While it may be a pragmatic move on the part of advertisers – going with the tried and true, familiar, wide channel (online and mobile), and cost considerations – the lack of more diverse mobile calls to actions and mobile tie-ins beyond social media engagement was noticeable.

Consumers also leveraged the mobile web to engage in Super Bowl and advertiser-related content. NFL/Super Bowl-related searches on Google, Bing and Ask properties represented nearly 5 percent of total searches on Game Day.

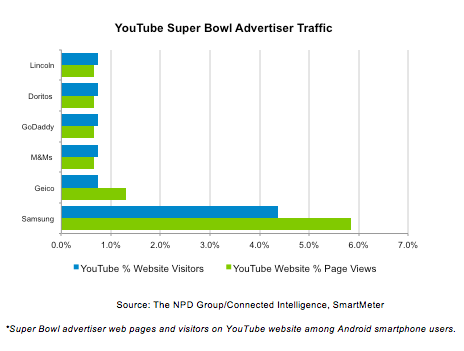

Samsung Mobile, followed by Best Buy and Pepsi led in terms of Super Bowl advertising-related mobile web activity. 10 percent of all YouTube mobile web pageviews were spent on Super Bowl advertising content (commercial pages, including video-viewing), and once again Samsung Mobile (“Next Big Thing”) made the most impact.

While sports and second-screen apps’ use was limited, the broader use and reliance on the smartphone for a host of activities – social media (Facebook, Instagram, twitter), search, mobile web, including video (YouTube) – highlight the immediacy and utility of the smartphone (small, second, companion screen) to support and complement the TV (big screen)-viewing experience. However, it is clear that the ecosystem is still experimenting with smartphone app experiences, and more work needs to be done so that they can become more mainstream, integrated (where appropriate), and an invaluable part of the Super Bowl experience.