The price hike cycle is complete with AT&T

AT&T last week announced that it will introduce increase the price of its older unlimited wireless plans, starting in August 2024. Single-line users will face a $10 increase, while multi-line family plan holders will see a single $20 hike per month, regardless of the number of lines included on the account. The affected plans include a broad array of AT&T's legacy unlimited offerings that have been popular for avoiding overage fees, though they often came with speed throttling and restrictions on hotspot data usage. To mitigate the impact of these price hikes, AT&T is enhancing the high-speed data and hotspot allowances for these plans, offering up to 100GB of high-speed data before throttling and 60GB of hotspot data for some plans.

The Circana Take:

- AT&T is the last major carrier to take a stab at modifying its legacy rate plans with the goal of boosting its service ARPU. The carrier’s motive and tactics are similar to that of rivals, where the objective is to persuade users to upgrade to newer service plans, which cost slightly more (even after the price hike) but come with many add-ons such as free streaming service subscriptions, improved international roaming or in-flight Wi-Fi options, and access to attractive trade-in deals for a new device upgrade. AT&T’s approach, however, is slightly more welcoming, as users who do not wish to migrate to the new rate plans will at least get more high-speed data or bigger mobile hotspot data bucket if they stay on the current plans.

- AT&T’s new price hikes on legacy plans should be welcomed by device makers, especially Apple, as users on these plans do not upgrade to new models because they do not qualify for the device subsidies offered on new rate plans. While rivals have previously talked about the difficulty in migrating users from legacy plans to new plans with price hikes, we would expect AT&T to perform well in this manner as it has the largest concentration of iPhones in the postpaid world and being able to qualify for upgrade subsidies on the upcoming AI-powered iPhone 16 will be hard to miss for many of the legacy plan users.

- Rival T-Mobile, during its earnings call back in April, announced that it will consider modifying legacy plan pricing to maintain revenue objectives, and come late May the carrier increased the legacy rate plans by $2 to $5 per month. Price hikes do not bode well with T-Mobile’s “value” DNA and the Uncarrier cleverly offsets these hikes by offering price locks on the expensive rate plans to maintain its value leader in perception in the minds of consumers. AT&T’s new rate hikes will help T-Mobile to further strengthen its value leadership in the postpaid market.

- The U.S. mobile landscape has been going through a major consolidation process with the three major network operators scooping up smaller players and increasing rate plans with little resistance due to lack of options apart from the cable MVNOs. We would expect Spectrum Mobile and Xfinity Mobile to continue to enjoy strong demand in the coming quarters, though they will need to be more aggressive with their promotional subsidies when the new iPhone 16 hits the market in September.

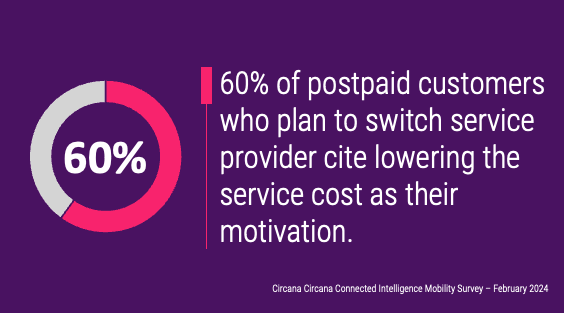

- The increasing postpaid service prices will be a lifeline for the prepaid market that has been gradually shrinking in favor of lower-end postpaid service offerings. As we have been commenting during our market update sessions, average U.S. consumer spending on tech products and services has been dropping notably due to tough macro-economic conditions, and price hikes will foster the frugal segment of the postpaid base to seek cost effective prepaid options. Those prepaid brands focusing on value and cost (e.g. Total by Verizon’s latest 50% off on unlimited campaigns) will be better positioned to win the hearts of these frugal postpaid customers compared to those carriers who focus their marketing on device-oriented perks (e.g. Metro by T-Mobile’s new Flex plans offering device financing and upgrades) as these legacy plan owners prioritize low service fee over a new device upgrade (hence over-index in BYOD).