Just six months after launching its free tablet data (200MB) offer, T-Mobile is back, pushing the boundaries further. Dubbed Tablet Freedom, the new offer gives tablet customers an extra 1GB of 4G LTE data for free until the end of the year. And there’s more: to help boost tablet sales, T-Mobile is subsidizing the price of 4G-enabled tablets, creating price parity with the Wi-Fi only versions (in the case with the iPad Air 16GB, customers will be able to purchase the 4GB version of the tablet for $499 versus the regular price of $629) with a zero-down installment plan. Moreover, customers will be able to trade in their old tablet (including Wi-Fi only tablets) and upgrade to a new tablet. And as a little more icing on the cake, T-Mobile will pay the ETF (Early Termination Fee) for those customers churning their tablet data subscriptions from rival carriers.

The combination of all these factors leaves little doubt that T-Mobile is getting very serious about tablets. But why now? Simply put, tablet connectivity is helping to improve customer loyalty across all carriers: every customer locked down with a tablet contract meant one less potential switcher to lure for T-Mobile. And with the two largest carriers offering Share plans that allow customers to quickly (and cheaply) add a tablet, there’s a relatively large number of loyal tablet users out there to target.

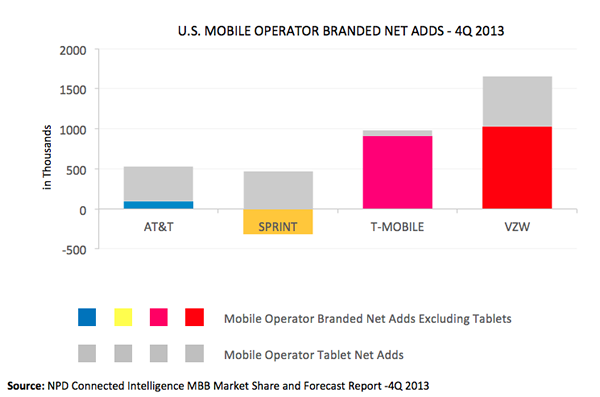

Between 1Q 2011 and 2Q 2013, T-Mobile lost an average of 490K retail postpaid subscribers every quarter. 2013 was the game changer, when the carrier transformed the industry with its Uncarrier program pushing the no-contract theme. Since then, T-Mobile has added an average of 730K retail postpaid subscribers per quarter, beating everyone but Verizon Wireless. In 4Q 2013, the most recent quarter published, T-Mobile grew by almost a million retail branded (retail prepaid and postpaid combined) customers. By contrast, T-Mobile’s tablet base is still low. Yes, Q4 was a far improved story, with roughly 70,000 new tablets, but by contrast the other carriers all saw tablet increases closer to half a million. And the 70,000 growth came with as a result of the free 200 MB promotion: clearly, while T-Mobile is seeing positive momentum, more was needed to truly jump start the tablet market.

So how did the other carriers do so well by comparison? Firstly, AT&T and Verizon have momentum on their side: they have been driving tablet connections for several years thanks primarily to selling Apple’s iPad. Additionally, with Share plans, both carriers offer a tempting proposition of sharing the basic pool of (already purchased) data for a small incremental $10 fee each month. By comparison, Sprint boosted its tablet base by bundling free Samsung Galaxy Tab 3 with the purchase of any Samsung smartphone (and a two year tablet contract). Free always helps drive a market, as the carriers discovered with Netbooks.

Sprint’s move, and the ongoing strategy of the Big Two certainly over-shadowed T-Mobile’s original 200 MB deal. Indeed, while the promotion certainly drove a lot of market buzz, the reality was that many consumers perceived it to be just too small an amount of data to be worthwhile. As a smartphone-toting nation, we’ve become accustomed to thinking in terms of gigabytes, not megabits. And as Sprint highlighted, the price of cellular tablets has also been a barrier to adoption.

Creating price parity with Wi-Fi tablets (especially for the iPads), and offering 1.2GB of free data till the end of the year will certainly help drive T-Mobile’s tablet success. But more importantly, if this success comes rapidly, it will also help drive down the price of embedded cellular tablets, as other carriers will need to consider a similar subsidization option, despite the industry’s general trend away from such approaches.