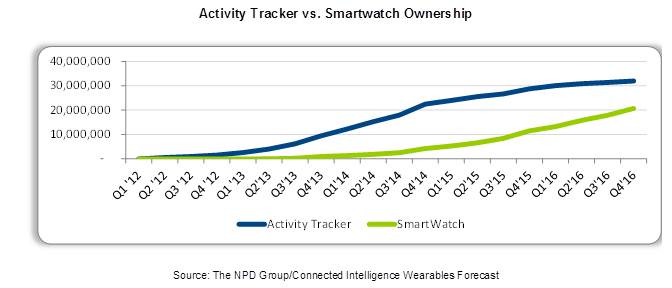

Smartwatch ownership in the U.S. is forecast to reach 9 percent of the U.S. adult population by 2016, closing in on activity trackers. According to The NPD Group Connected Intelligence Wearables Forecast, as smartwatch penetration grows, activity tracker penetration will begin to plateau. By the end of 2016 activity tracker ownership will have peaked at 32 million after growing significantly for four years.

“The smartwatch will clearly begin to take a bite out of the activity tracker market moving forward,” said Eddie Hold, vice president, Connected Intelligence. “The fact that the health and fitness apps on smartwatches are a key marketing focus will help draw consumers away from the simpler trackers.”

The activity tracker, however, is not just under threat from the smartwatch but actually from itself as well. Counting the number of steps taken on a daily basis is only a small part of the activity trackers’ appeal, therefore limiting the addressable market size for these devices. In fact, 40 percent of activity tracker owners stop using the device within six months.

“The good news for activity trackers is that we are seeing a clear opportunity at the more sports-focused end of the landscape,” continues Hold. “There is demand for a more sophisticated class of activity tracker that supports GPS and heart rate monitoring, while also being a little more rugged and waterproof. And while we see the simpler fitness trackers potentially hitting a wall, these advanced devices will continue to drive adoption.”

But more than simply devices, both the smartwatch and the activity tracker markets will be defined by the available apps over the coming year. Third party activity apps will be key to both the growth of the sport-related activity tracker market, and to the long-term stickiness of the smartwatch use.

“While all of these new products will definitely help drive demand, the real test will be the apps for the smartwatches,” said Hold. “There will definitely be a demand for these devices and the use-case will follow, but smartwatch manufacturers and app developers need to make these products become ‘need to haves’ rather than ‘nice to haves’.”

Methodology

Connected Intelligence Wearables Forecast

Five thousand U.S. consumers, aged 18+ responded to an online survey in Q1. The consumers reported their awareness of, ownership of, and intent to own wearable devices. In addition, several questions in the report were fielded using Civic Science. Civic Science provides the leading intelligent polling and real-time insights platform, partnering with hundreds of premier websites to survey millions of people daily. Its proprietary technology rapidly analyzes consumer opinions, discovers real-time trends, and accurately predicts market outcomes. This service is used to examine consumer attitudes towards activity trackers and smart watches, as well as emerging wearable technology.