Verizon reinvents retail amid the COVID-19 pandemic

Ronan Dunne, the Executive VP and CEO of Verizon Consumer Group, last week announced the carrier’s ambitious plans to re-open the retail locations that were forced to closed down due to the pandemic. Verizon, which initially closed down 70% of its company-owned retail stores, had 40% of them open as of last week, and is striving to get that figure up to 50% in June. The carrier is planning to open the retail locations in phases and will use a guideline dubbed “Touchless Retail” to ensure employee and customer safety. Based on the new guideline, the carrier will only accept visits by appointments for critical troubleshooting and instore pickup for new device purchases. Verizon will also enforce social-distancing measures between the employees and customers, and will reduce its selection of on-floor inventory and demo products (including a 15% cut on the demo products and a 50% reduction in accessory selections). Verizon will also reduce the customer sitting areas as well as kids zones that feature kid-specific products such as tablets and trackers.

The NPD Take:

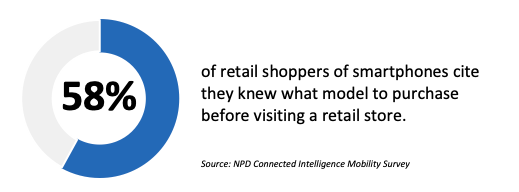

- Verizon’s roadmap to re-opening its retail outlets is good news for smartphone manufacturers considering that over three quarters of U.S. smartphone users shop in retail outlets. The reduction in the smartphone demo units is not as big of an issue as close to 60% of U.S. retail shoppers of smartphones cite that they knew the exact smartphone model they wanted to purchase prior to visiting a retail outlet.

- Verizon’s “Touchless Retail” guidelines will take its toll on accessory and connected device sales. Carrier retail outlets enjoy relatively high accessory attach rates (over 30%) and a 50% decline in the selection will likely lower the attach rates. Similarly, the elimination of sitting areas and kids zones will limit Verizon reps ability in pushing LTE connected devices such as tablets, trackers and smartwatches.

T-Mobile (again) leads in postpaid additions

We previously reported on AT&T and Verizon’s Q1 2020 performance including a 163K new postpaid phone additions and 307K postpaid phone losses, respectively. Last week, it was T-Mobile’s turn to release its figures. Unsurprisingly, T-Mobile, which has long been leading the market in new subscriber additions, announced 777K new postpaid subscribers, 452K of which were postpaid phone additions. On the other hand, the carrier lost 128K prepaid subscribers; this is the first time T-Mobile has seen its prepaid base contract since 2011. [The only other time was back in Q3 2019 when the carrier transferred over 600K prepaid clients over to an MVNO client.] T-Mobile also announced a record-low postpaid phone churn of 0.86% in Q1 2020.

The NPD Take:

- Despite T-Mobile’s continuing to lead the industry in postpaid net adds, it should be noted that this was one of the carrier’s poorest Q1 performances due to the COVID-19 pandemic. The carrier has been a churn magnet for AT&T and Verizon postpaid customers looking to lower their monthly bills, but the closures of the retail stores have resulted in an industry-wide decline in number porting (switching) activity in Q1 2020.

- T-Mobile’s record-low postpaid churn was driven by the store closures, but the carrier’s Q1 churn performance (0.88%) was not that different than the record churn performance enjoyed in Q1 2020. The carrier has already been enjoying low churn levels, thus the closures of retail outlets hurt the carrier more than the others as it limits the exodus from other carriers.

LG debuts the new Velvet series

Earlier in April, we reported on speculations that LG was building a new flagship series to replace its G series, which has been the South Korean OEM’s (weak) response to Samsung’s Galaxy line of smartphones. LG last week officially announced its new device line dubbed the Velvet, which boasts Qualcomm’s mid-tier Snapdragon 765 chipset as well as a 6.8-inch display (with a tear drop notch at the top center) and a triple-camera design featuring a 48 megapixel wide angle lens. The phone will commercially debut on May 15 in the South Korean market and will retial for around $730. LG did not provide any details about the phone’s global shipment timing and price.

The NPD Take:

- LG has long been struggling with its flagship series (the V and G series phones) that have not been able to “connect” with consumers. The OEM’s design innovations such as curved form factor (the G4), modular built (the G5), the boombox screen (the G7) or the gesture controls (the G8) have been great marketing statements but they were simply marginal features at best. This disconnect has cost LG dearly as it lost significant market share to existing rivals such as Samsung and newcomers such as Google and OnePlus.

- LG’s diversified portfolio strategy with the G and V series phones have lately been confusing due to overlapping specs and launch schedules. The V series, which initially emerged as a video-centric franchise, has recently been a replica of the same generation G series model (or vice a versa). Considering LG chipset option (Snapdragon 765 versus the 865 on the V60 Thinq) and the price tag on the new Velvet, it’s safe to assume that V series have officially become LG’s solo flagship going forward.