AT&T and Verizon report Q3 performance

AT&T and Verizon announced the results of their financial and operational performances for the third quarter last week. Verizon was the first to take the stage last Wednesday when it announced a total of 283K new postpaid phone subscribers, which were evenly split between its consumer and enterprise businesses. The carrier actually ended the quarter with only 131K new postpaid subscribers in total as losses from consumer connected tablets slightly offset the gains from the new phone accounts. Verizon also reported a gain of 77K prepaid subscribers, a surprisingly high figure considering the 213K prepaid customers lost in the previous quarter. The carrier’s churn (0.80%) in the consumer business increased slightly from the previous quarter’s record low levels (0.69%), but it was still lower than the pre-pandemic periods. Rival AT&T, on the other hand, had a massive quarter with 645K new postpaid phone additions, 151K of which were previously written-off customers (as part of the FCC’s Keep America Connected pledge) who made their payments, and were thus re-added to the books in the third quarter. Like Verizon, AT&T saw its prepaid base increase by 245K accounts and 131K of those were phone connections (meaning the carrier had over 100K prepaid connected device net adds during the quarter). Incidentally, AT&T’s consumer phone churn rates dropped to 0.69% during the quarter.

The NPD Take:

- AT&T’s Q3 2020 postpaid phone performance is impressive considering that the carrier’s cumulative postpaid phone additions in the entire year of 2019 were less than this single quarter. The growth is a result of the simplified unlimited service plan offerings, starting at $35/month, as well as aggressive device subsidies (particularly on the flagship Android front). The increase in the prepaid connected device base is also noteworthy; while AT&T did not provide details on whether this growth was achieved via smartwatches, tablets, or hotspots products, the carrier did allude to hotspots (in general – postpaid/prepaid combined) helping boost device revenues during the quarter.

- This is the first time since Q3 2017 Verizon has announced gains in prepaid subscribers. The carrier has lost close to 2 million prepaid subscribers in the past three years and the addition of 77K new subs on the heels of the Tracfone acquisition announcement is certainly welcome.

Boost Mobile fuels the prepaid price wars

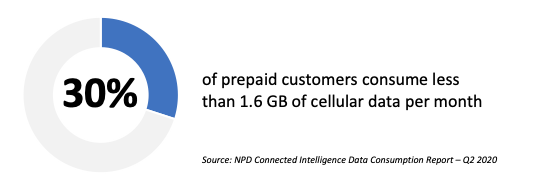

Dish Network’s Boost Mobile prepaid MVNO last week announced a new rate plan promotion offering new customers 2GB of data for three months for only $10/month. After the third month, the data allowance drops to 1GB. The MVNO also has an upper-tier plan that offers 4GB for three months at $15/month. In this case, the data bucket size drops to 2GB after three months. Both plans require new customers to bring their phones (that are compatible with the T-Mobile network Boost service runs on) and will be valid through the end of the year.

The NPD Take:

- Boost Mobile launched a similar promotion right before the Dish Network take over in April when new customers received 2GB for $15/month for two months in response to T-Mobile Prepaid and Cricket’s $15/month plans. The price of the Boost plan went back to $30/month after the promotional period ended. The new rate plans available through the end of the year are much more aggressive compared to the promotional plans announced in April, signaling Dish’s eagerness (and desperateness) to bring in new customers at a time when both prepaid and postpaid carriers are enjoying record-low churn rates.