Carrier earnings begin to surface

AT&T and Verizon took the stage last week to announce the results of their financial and operational performances for the initial quarter of the year. Verizon went first, announcing a loss of a quarter million phone subscribers on the consumer side, though this was partially offset by the 47K new phone lines added on the business side. Verizon has also reported a gain of 19K prepaid subscribers making up somewhat for the 50K subscriber loss in the previous quarter. The carrier also saw its retail postpaid churn slightly increase to 1.03% (from 0.96% in the previous quarter) while the postpaid phone churn was 0.81%. Notably, Verizon enjoyed a revenue growth of 2.5% from last year (consumer side up by 1.5%, business side up by 6.2%).

Rival AT&T, on the other hand, had another massive quarter with 595K new postpaid phone additions on top of the 1.5 million new postpaid phone subs added in the previous two quarters. The 10-year high Q1 postpaid phone net additions performance is also more than triple the figure (163K) captured in Q1 2020. The carrier also added 207K new prepaid subscribers during the quarter compared to only 17K new prepaid additions last quarter and a loss of 47K prepaid subscribers in the year-ago quarter. Incidentally, AT&T’s postpaid phone churn was recorded as 0.76% (down from 0.86% a year ago; the same as in the previous quarter).

The NPD Take:

- AT&T surprised the industry in late October when it announced the extension of its new iPhone subsidies to its existing customer base. Having the largest postpaid iPhone penetration, AT&T was expected to take a significant hit in Q4 as its iPhone user base would be shopping around elsewhere to take advantage of the switcher offers. AT&T’s aggressive promotions not only help retain the base (keep the churn at near record-low levels) but also attracted customers from other carriers in two consecutive quarters.

Xfinity Mobile discounts multi-line 5G plans

Comcast´s mobile MVNO, Xfinity Mobile, recently rehauled its unlimited service plan offerings to include 5G access. The MVNO´s classic $45/month per line unlimited plan now comes with 5G support, free of charge, and additional discounts for multline accounts. The carrier charges $80/month for two lines, $100/month for three lines, and $120/month for four lines or more. Notably, each line´s data access speeds are throttled once they hit their 20 GB/month allotment. Xfinity Mobile also allows customers mix and match shared data buckets priced at $15 for 1 GB, $30 for 3 GB and $60 for 10 GB. Xfinity customers who join one of these new rate plans are also offered a free Motorola one 5G ace phone, which typically sells for $299 ($12.24/month for 24 months).

The NPD Take:

- Xfinity Mobile’s new 5G plan pricing is more affordable than before, but it’s still not as competitive as T-Mobile’s entry level Magenta Essentials plan, which offers 50 GB/month high-speed 4G/5G data (vs. Xfinity Mobile’s 20 GB/month) at $26/month per line.

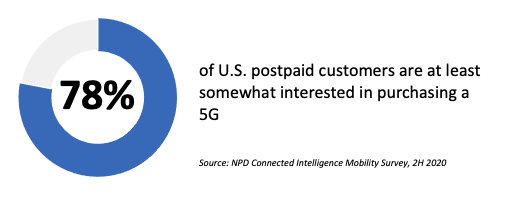

- Xfinity Mobile’s free 5G phone promotion is worthy of mention, considering the growing 5G interest among US mobile consumers. According to the recent NPD Mobile Connectivity Survey, 84% of postpaid phone customers are at least somewhat interested in purchasing a 5G smartphone when it’s time to upgrade.