Dish to Start Dishing AT&T to MVNO Base

Dish Network is switching its MVNO service from T-Mobile to AT&T networks with a 10-year agreement. This will make AT&T the primary service provided to Dish’s Boost Mobile, Ting Mobile and Republic Wireless customers. AT&T will be able to make use of a portion of Dish’s spectrum in some markets to bolster service to the MVNO customers. Dish is also building a 5G network that they vow will cover 70% of the US population by 2023 and will connect the MVNO customers.

NPD Take:

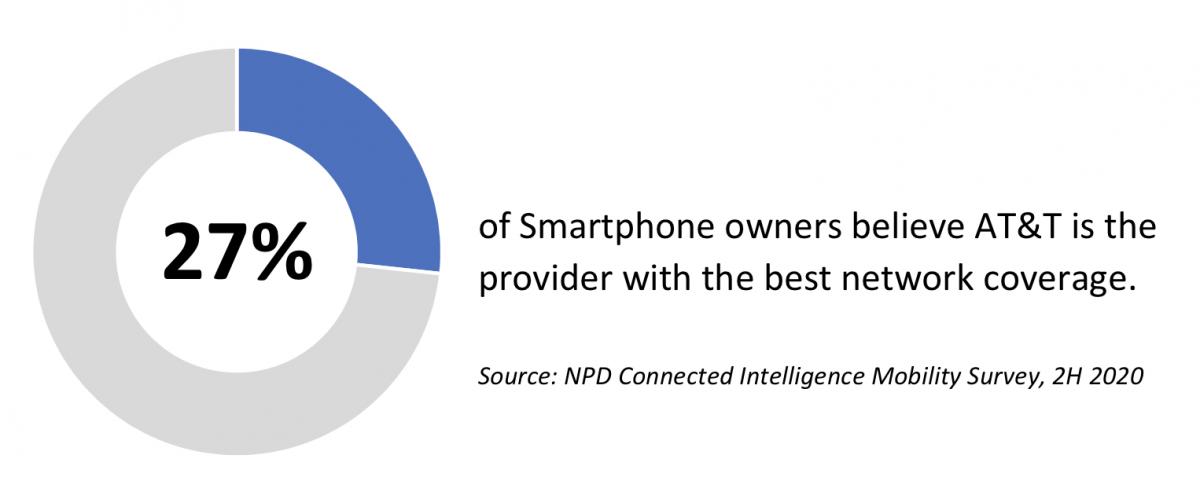

- AT&T’s partnership with Dish looks similar to Verizon’s long-standing partnership with the cable MVNOs where the MVNOs have been offered preferential rates in return for spectrum swaps that improve Verizon’s network management. As in the case with cable MVNOs poaching Verizon’s customers, if AT&T lose prepaid customers to any of the Dish prepaid brands, it can still generate revenue out of them via the new MVNO deal.

- According to the NPD Connected Intelligence Rural America Report, 31% of households in the US do not have broadband internet access. Dish’s press release about the AT&T agreement states their OpenRAN-based 5G network will reach over 70% of the population by 2023, including 38 cities. AT&T’s plan is to cover 200 million people nation-wide by the end of 2023. Expansion of 5G networks across the country could be what’s needed to connect under-served (and often rural) communities to the internet; however, they can’t stop at only covering the most populated cities.

Q2 Carrier Earnings Are Looking Good So Far

Verizon was first to release earnings for Q2 2021, reporting growth in wireless subscribers as well as service revenue. Verizon’s total consumer revenue grew 11.2% year over year. With a total of 275k net phone additions (197k consumer, 78k business) in the postpaid segment, this is a big contrast to the losses reported in Q1 2021. A record-low consumer postpaid churn rate of 0.65% and the reopening of corporate-owned retail stores contributed to the growth. A noteworthy highlight is the 5G device upgrade rate with around 20% of Verizon Wireless customers owning 5G capable phones by the end of Q2 2021. Verizon also added 18k prepaid customers, ever so slightly below Q1’s prepaid additions.

AT&T announced the addition of 789k postpaid phone net adds and 174k prepaid, beating last quarter’s impressive numbers. The carrier also enjoyed a 0.69% postpaid phone churn rate, matching the record rate observed in the year-ago-quarter when the entire industry saw their churn rates plummet to all-time-low levels due to the pandemic. AT&T total mobile revenue grew 10.4% year over year. During the earnings call, AT&T CEO John Stankey said the company also continues to invest in 5G, with $60 billion in the last 12 months.

NPD Take:

- In alignment with NPD Connected Intelligence Mobile Predictions from March 2021, the reopening of carrier retail stores and return to near-normal levels of customer activity have helped drive this quarter’s success, especially as carriers timed promotions to attract subscribers. NPD’s prediction explains how the uniqueness of the mobile business lies in the complexity of the activation process and encourages consumers to step inside.

- Reopening stores plus well-timed promotions equals more in-store traffic, which encourages device sales and add-ons. Attach rates of additional devices (like smartwatches and tablets that can be added to service plans) and device accessories (screen protection, mobile power) at the time of purchase is another source of revenue for carriers that is more likely with in-store shopping.

- Verizon certainly earned the bragging rights for having a fifth of its base on 5G phones, but it is important to highlight that this success was achieved via aggressive device subsidies extended to its existing user base. Notably, Verizon’s aggressive free 5G device upgrade offer has ended only a day after earning call, and it will be interesting to see if the carrier can maintain the 5G upgrade momentum without the “free phone” bate in Q3.