AT&T and Verizon release Q1 2022 Earnings

AT&T and Verizon announced the full results of their financial and operational performances for the initial quarter of the year. AT&T was the first to take the stage to announce another stellar quarterly performance with another 690K postpaid net adds on top of the 1.5 million postpaid net adds recorded in the second half of last year. Notably, this is the best postpaid net add performance has AT&T posted in over a decade. AT&T also announced 116K new prepaid customers (113K of which were phone adds), up from only 14K added in the previous quarter. AT&T’s postpaid phone churn was recorded as 0.79%, down from 0.85% in the previous quarter. Rival Verizon, on the other hand, posted a loss of 36K net postpaid phone subscribers. While this figure is quite alarming compared to last quarter (Q4 2021) when Verizon added over half a million net postpaid subscribers, it marks an improvement from the same quarter of last year when it lost 70K postpaid subs. Nevertheless, it is important to highlight that it was Verizon’s business division that stopped the bleeding as it added 256K net postpaid phone lines to offset the 292K net postpaid phone lines lost on the consumer side. Verizon’s prepaid business also saw a contraction of 80K lines on top of the 85K lines lost in the previous quarter, which was the first financial period including the figures of the newly acquired Tracfone business.

The NPD Take:

- AT&T delivered another impressive quarterly performance with 691K new postpaid phone subscribers, but it is important to keep in mind that close to half of these were FirstNet (emergency first responders) customers, whose revenue contributions will not be similar to what AT&T enjoys from its regular postpaid retail customers. AT&T’s 116K new prepaid subscriber additions (almost all of which are phone lines) are also noteworthy considering rival Verizon’s struggling prepaid performance.

- Verizon’s loss of close to 300K postpaid consumer phone lines is alarming but it is important to remember that Verizon has been steadily losing postpaid phone subscribers to Comcast’s and Charter’s cable MVNO services, and thanks to being the network partner of the MSOs, Verizon gets to continue to enjoy wholesale revenues from these lost-to-cable customers.

BLU joins the 5G game

The unlocked phone maker BLU last week announced the availability of its first 5G-powered smartphone, the F91 5G. Running on MediaTek’s latest Dimensity 810 silicon, the phone boasts a 6.8-inch display, quad-lense cameras, 128 GB of storage with 8 GB of RAM, NFC, and a 5,000 mAh battery. BLU’s first 5G phone is now available through Amazon.com for $219, which is $80 below its MSRP of $299.

The NPD Take:

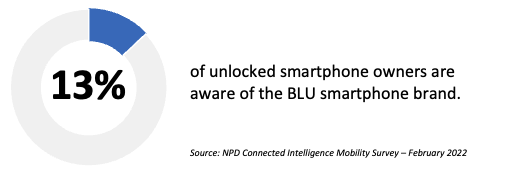

- BLU has had notable success in the low-end unlocked phone business despite a high return rate for its smartphones. According to NPD Connected Intelligence’s Mobility survey, BLU enjoys a 7% awareness rate, which climbs to 13% among unlocked smartphone customers. The growing awareness of the BLU brand helped the OEM win slots at Tracfone, but the F91 5G will likely not makes its way to Tracfone due to lack of 5G compatibility.

- While the discounted $219 price tag on the unlocked F91 5G is appealing, it will not be enough to compete against unlocked entry-level 5G smartphones from more established players. Best Buy, which has long been a distributor of BLU unlocked phones, is currently selling Samsung’s A13 5G and OnePlus’ Nord N200 5G unlocked smartphones for $249 and $239, respectively.