The Un-Stoppable

T-Mobile last week announced the results of its Q3 2022 operations, and once again led the industry with 854K new postpaid phone subscribers joining its network. Notably, this was the highest figure recorded since the last quarter of 2019 when the carrier passed the million mark. The carrier’s prepaid business also grew by 105K on top of the 146K new prepaid subscribers added in the previous quarter. T-Mobile sold 8.4 million phones during the quarter, which was significantly down from 9.8 million units sold in the year-ago quarter (hence the drop in the upgrade rates from 4.3% to 3.8% YoY). Incidentally, T-Mobile’s postpaid phone churn, which had previously hit a record low of 0.8% in Q2 2022, increased slightly to 0.88%. Similarly, prepaid churn inched up slightly from 2.58% in Q2 2022 to 2.88% in Q3 2022. Finally, T-Mobile announced that it has added another 578K high-speed internet customers, 90K of which were on the Metro by T-Mobile prepaid business. Notably, the carrier now serves over 2.1 million internet subscribers.

The NPD Take:

- T-Mobile’s postpaid phone net add performance is noteworthy when compared to rivals AT&T and Verizon. AT&T earlier announced net postpaid phone additions of 708K, though close to half of these were low-ARPU FirstNet customers. Verizon, on the other hand, announced a gain of 8K postpaid phone net adds (Verizon lost close to 190K consumer postpaid phone subs, but the gains on the enterprise side of offset these losses).

- The addition of over half a million FWA internet customers attests to how big of a threat T-Mobile (and Verizon, which added 234K FWA subs during the quarter) for the cable industry. Charter, for instance, has so far added only 240K internet subscribers during the first three quarters of the year, compared to two million and one million new internet customers added in the first three quarters of 2020 and 2021, respectively.

- The drop in T-Mobile’s upgrade rates (and devices sold) is a positive sign given that the carrier was able to maintain (the churn is only slightly up) and grow with having to subsidize a smaller number of devices than before. One driver would be the carrier’s growing Apple iPhone user base, which typically upgrades later than the average Android user.

- T-Mobile was able to grow its prepaid base slightly (up 105K), while attracting 155K Metro and T-Mobile Prepaid customers over to the postpaid Magenta side. As noted in our recent market update presentations, we expect the ongoing prepaid-to-postpaid migration to slow down in parallel to the anticipated deterioration of macroeconomic forces.

The Cable MVNO momentum shows no sign of slowing

Comcast and Charter last week announced the results of their Q3 2022 operations. Both cable MVNOs continued to ride the momentum they have been enjoying for the past several years with a cumulative record 729K new mobile subscribers added during the quarter. Charter’s Spectrum Mobile, which had previously hit the four million subscribers mark last quarter, added a record 396K new mobile lines during the quarter and passed the 4.5 million mark. Spectrum Mobile’s 9-month aggregate net adds in 2022 (1,113K) were almost on par with the cable MVNO’s annual net subscriber adds in 2022 (1,189K). Spectrum Mobile’s quarterly revenues increased by 40% YoY, though so did its expenses (up 39% YoY). Comcast, on the other hand, ended the quarter with 4.95 million mobile subscribers with 333K net adds. The company, during the financial earnings announcement (which took place couple weeks after the end of the quarter), revealed that it has indeed passed the five million subscriber mark, a milestone reached in five years since debut. Comcast’s Q3 mobile revenues grew by 30%.

The NPD Take:

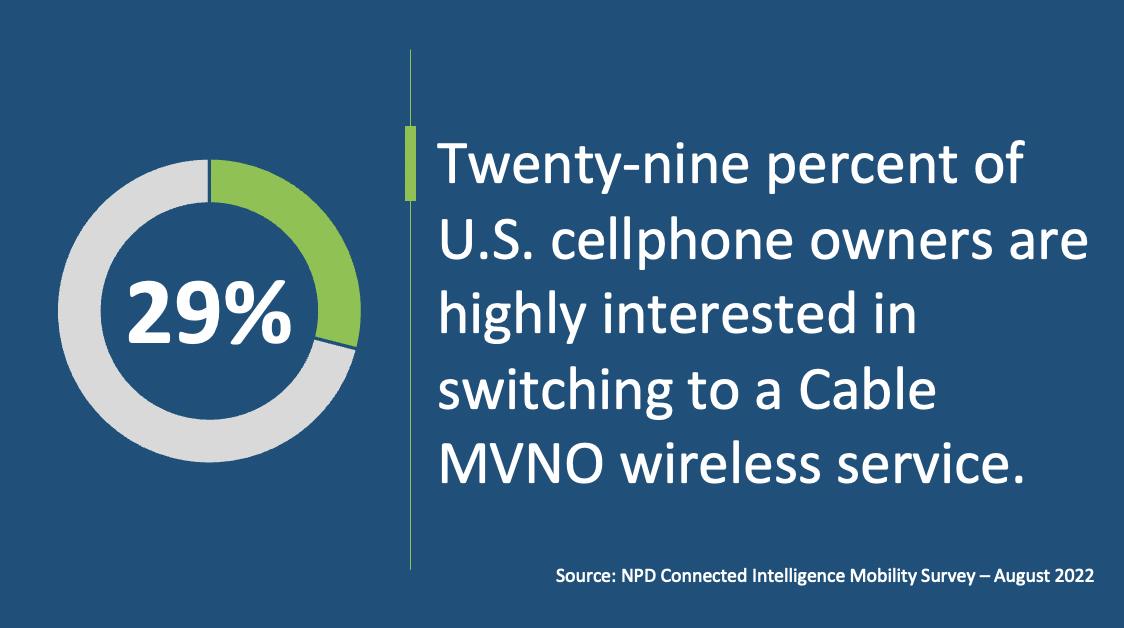

- The Cable MVNOs’ direct marketing and aggressive pricing continue to put pressure on wireless carriers, which have experienced a migration of close to ten million subscribers over to the cable MVNO side. Ongoing campaigns such as the $29.25/month unlimited data plan or the $49/month fiber cable and unlimited data bundle at Spectrum will continue to keep the pressure high in the coming quarters.

- The two cable operators are poised to become an even greater threat once the deployment of their CBRS-based network buildouts begins in dense urban areas. As noted earlier, revenues are rising in parallel to the growth in the subscriber base, but so do the costs to welcome these new users. Comcast and Charter will be able to get much more aggressive.