Cox Mobile officially debuts

The cable operator Cox Communications has launched its much-awaited cellular phone service, dubbed Cox Mobile. The company has been trialing the services in three test markets (Las Vegas, Hampton Roads, and Omaha) since August, and has decided to use CES Show as the official launch pad of its new Cox Mobile service, which is available for all Cox Home Internet customers in the 18 states it serves. Cox Mobile offers two rate plans: the “Pay As You Gig” plan priced at $15/GB as well as an Unlimited plan (priced at $45/month) that offers 20 GB of data at 4G/5G speeds (throttles to 3G speeds afterwards). Cox Mobile’s service will run on Verizon’s 4G and 5G networks. Notably, the cable MVNO’s device lineup does not include any Apple iPhone models and is limited to a full range of Samsung models (from the low-end Galaxy A series to the high-end Galaxy Z Fold series).

The NPD Take:

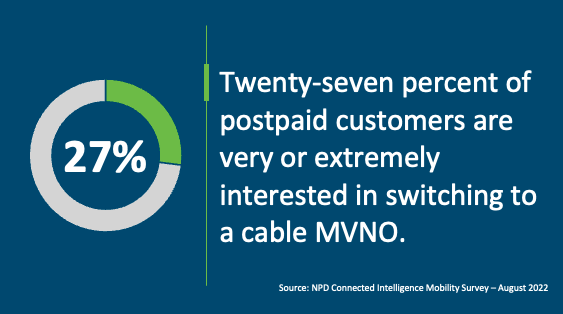

- Cox follows the footsteps of Comcast and Charter, which combined managed to attract close to ten million mobile subscribers away from the big three carriers. Cox’s home internet user base is considerably smaller than that of Comcast and Charter, but it is enough to make additional dent in the big three’s postpaid bases.

- Selecting Verizon as their network provider has given both Comcast and Charter the opportunity to offer a top-notch network experience with little coverage worries. This network advantage has helped the companies to focus on other operations and grow to the levels we see them at today. While Cox Mobile’s decision to go with Verizon will give the new cable MVNO the much-needed peace of mind, it is important to highlight that Verizon is no longer the sole king in network coverage/reliability, as T-Mobile’s mid-band 5G network has improved and grown substantially in the last two years.

- The lack of Apple devices is clearly going to be a limiting factor for Cox, no doubt driven by the high purchase commitments required by Apple. While the cable MVNO business model is highly BYOD-centric, Cox Mobile cannot replicate Charter or Comcast’s success with a Samsung-only selection as close to 60% of U.S. postpaid subscribers are on iPhones.

- Verizon’s network MVNO deal with Cox Mobile may be perpetually fruitful for the carrier as, unlike Comcast and Charter, Cox Mobile will not be enjoying any sort of owner’s economics to offset wholesale costs by launching its own network in dense areas.

Satellite communications coming to Android

CES is by far the world’s most colorful industry event in the technology sector, but mobile announcements had always been subdued with most mobile-centric players waiting till next-month’s Mobile World Congress to show of their latest products. But several mobile announcements did make the show, with the release of several new Android models from Motorola (the Lenovo-themed ThinkPhone for enterprise users) and Samsung (the Galaxy A14, the company’s latest Galaxy A10 series entry-level phone). Even more notable was Qualcomm’s new satellite communication solution that allows Android users to connect to satellites when out of cellular coverage for SOS services and two-way texting (as available on Apple devices already). The embedded solution is expected to appear on new Android smartphones running on its new Snapdragon 8 Gen 2 chipset beginning the second half of the year.

The NPD Take:

- While the satellite communication solutions cater to an exceedingly small niche consumer market and a small enterprise segment, these solutions help brands differentiate themselves in the market. Apple has been doing a decent job of marketing the satellite support of its latest iPhone 14 Pro phone, and Qualcomm’s new solution will help Android competitors offset this marketing advantage.

- The mobile hardware makers are not the only ones focusing on satellite solutions to add value and differentiate themselves from competitors. U.S. carriers including T-Mobile (through the partnership with SpaceX) and AT&T (through the partnership with AST) have also jumped on the satellite solutions bandwagon to provide their customers ubiquitous connectivity in areas with no cellular connectivity.