Churn Wars: Verizon Strikes Back

Let us start out by clarifying that by no means we are equating Verizon with “the Empire” or T-Mobile with “the Resistance” as the two opposing forces of the Star Wars franchise. But last week’s switcher deals announced by the two carriers have truly ignited a new churn war, and it was not easy to resist the temptation of referencing the saga’s top movie, The Empire Strikes Back.

T-Mobile fired the opening salvo by offering one of the most aggressive switcher deals in recent memory: up to four lines of free service for three months to customers switching from AT&T or Verizon. To qualify, customers must sign up for a primary line on one of Mint’s rate plans, priced between $25/month and $45/month, with an introductory offer of just $15/month for the first three months. This deal allows up to four additional lines to be added at no cost for the promotional period.

Verizon was quick to counter T-Mobile’s move, targeting single-line users of T-Mobile with its Visible digital MVNO. Verizon’s offer includes a $10 discount on Visible’s $25/month Unlimited plan, backed by a five-year price-lock commitment. T-Mobile customers can activate this deal by using the promotional code BYEBYETMO during the switching process.

The Circana Take:

- T-Mobile and Verizon’s latest switcher promotions offer a much-needed boost to the prepaid market, which has been shrinking in favor of postpaid services over the past few years. However, while these promotions aim to increase subscriber bases and revenues by poaching customers from rivals, they are also likely to drive down industry ARPU (Average Revenue Per User). The U.S. mobile market has enjoyed high service margins compared to other global markets where fierce competition has driven prices and margins lower. The three major postpaid carriers have capitalized on market consolidation to gradually increase service prices. Yet, with the line between postpaid and prepaid offerings increasingly blurred, this race to the bottom in pricing could negatively impact carriers’ profitability in the long run.

- The high volume of switcher activations for Mint Mobile and Visible, driven by these promotions, will likely lead to fewer new phone sales, as both offers are BYOD-centric. Typically, users upgrade to a new device when switching carriers to take advantage of device subsidies. While upgraders can still access these subsidies, they must subscribe to premium plans to benefit. We anticipate that many of the new Visible and Mint Mobile customers will opt for lower-tier devices when they’re ready to upgrade, as they won’t qualify for new device subsidies.

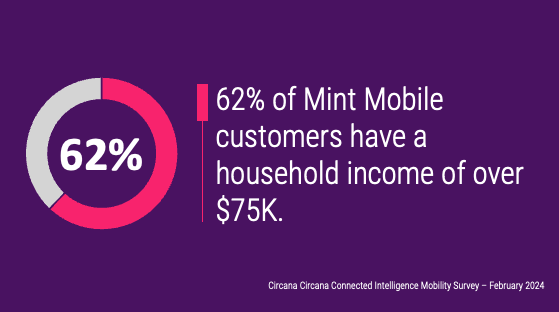

- T-Mobile’s execution with this promotion is on point, as Mint Mobile isn’t a typical prepaid brand catering exclusively to low-income groups. According to Circana’s Mobile Consumer Tracking database, Mint Mobile customers tend to be more affluent, with higher incomes and education levels than the average prepaid customer. This gives T-Mobile a real opportunity to attract value-conscious users from AT&T and Verizon, bolstered by Mint’s innovative marketing campaigns featuring Ryan Reynolds.

- Verizon’s swift response to Mint Mobile’s new offer underscores its heightened focus on the value segment. Visible, a key brand in Verizon’s value prepaid portfolio, offers a compelling value proposition that should resonate with T-Mobile’s younger, single-line customer base. The five-year price-lock is particularly attractive, and while it may result in lower ARPU for Verizon in the short term, it could also entice some of these users to upgrade to its $45/month Visible+ plan, which includes a free connected smartwatch service (normally $10/month) as well as premium data and international roaming features.