Last week, under the shadow of a dozen new Echo devices, Amazon continued their pursuit to redefine TV. The latest product launch expanded the Echo device ecosystem deeper into the home with new speakers, a plug, clock, microwave, and other voice-enabled gadgets. Further, the all new Fire TV Recast device is aimed at routing a larger portion of consumers TV viewing time through Amazon’s ecosystem of hardware and services.

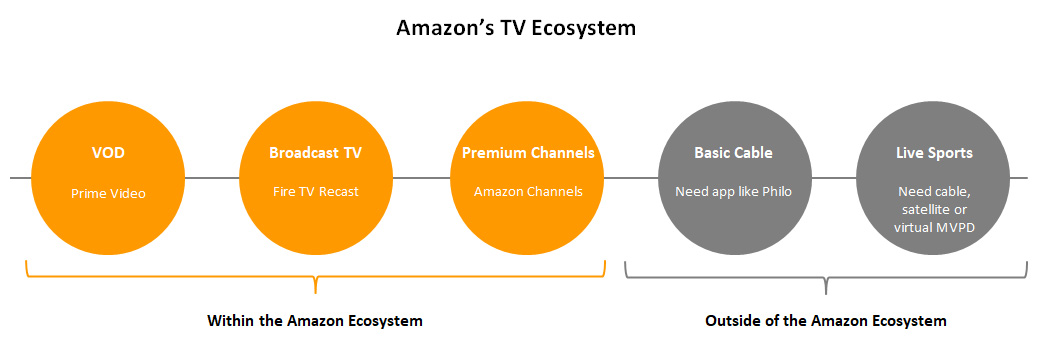

Amazon has long been developing its TV ecosystem through hardware and programming advancements. As such, Prime Video expanded beyond being a traditional video-on-demand library to offering a robust and growing array of original programs. And Prime subscribers that wish to add-on TV options have a robust line-up of channels to cherry-pick from. These span all of the premium movie networks such as HBO, family channels like Boomerang, and many more. Indeed, Amazon Channels has been cited as facilitating a sizable portion of subscriber growth for these direct-to-consumer TV Network offerings. By nature, Channels is set-up as a subscription model, not built to offer broadcast TV or ad-supported networks. It’s Fire TV Recast that solves the first of these challenges.

Recast is essentially a TV tuner and DVR. The device connects to a single indoor digital TV antenna and re-broadcasts that signal using its integrated tuners. The magic is that the re-broadcast occurs through Wi-Fi which mitigates the need for Recast to be in the same room as the TV. When it comes to antennas this solves a common obstacle, as the TV room doesn’t always have line-of-sight to the local broadcast tower. Beyond solving the placement issue, Recast includes either two or four tuners, which allow a single antenna to broadcast multiple concurrent streams and has a built in hard drive to serve as a DVR. The signal then streams to your Fire TV, providing live, local broadcast TV at no cost – and here’s the key, through Amazon’s hardware ecosystem. When coupling Prime Video, Amazon Channels, and Recast consumers are able to acquire a large portion of their TV programming all through one bill and user interface.

Granted, there remain programming gaps, as not all of the video content consumers want is being delivered through Amazon. For now, most basic cable networks can be obtained with a $16 a month subscription to Philo, filling that gap. But it remains to be seen how, if at all, Amazon integrates ad-supported basic cable channels into their TV ecosystem. A simple partnership with Philo is one route where building an Amazon Channels-like model for ad-supported services would provide deeper integration and a revenue stream for the company. Indeed, all of these networks already have apps, just ones that are tied to cable and satellite TV subscriptions through authentication. It wouldn’t be a leap for them to become available through or “authenticated” by an Amazon Channels type service where Amazon took a cut of the ad revenues, a strategy the company has been squarely focused on recently.

Live sports are the other gap that Amazon has taken strides to fill with deals such as that with the NFL to stream Thursday night football. But the lack of comprehensive regional sports offerings leaves fans beholden to larger TV channel bundles from cable, satellite, and virtual MVPD providers. This gap will take longer to solve, as many of the leagues have long-term distribution deals in place.

Fire TV Recast does not complete the Amazon TV offering, as none of the company’s services or devices has been constructed to solve their entire TV distribution strategy. Rather, it fills a large gap and should be looked at in context of Amazon’s broader TV offering, as well as the company’s drive to generate revenues by capturing audiences everywhere they engage with content and services.