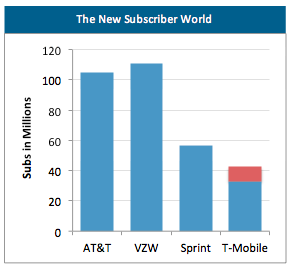

T-Mobile USA and MetroPCS are getting married. The deal, announced today, will result in a merged entity – to be called T-Mobile – that has 42 million subscribers and a far stronger overall spectrum holding. The new T-Mobile will still be the fourth largest U.S. carrier (Sprint is third with 56+ million subscribers) but the other benefits of this deal are more significant. And this reflects the new era of mergers: they are smaller and are as much about spectrum assets as they are about economies of scale and subscribers (the latter being the classic metric used to judge a mobile merger).

The two companies have complementary spectrum assets that will support LTE build-outs. Even more significantly, due to MetroPCS’ traditional focus on densely populated areas, the spectrum is very valuable as it strengthens T-Mobile’s network in the areas where the demand is greatest. T-Mobile estimates that by the end of 2015, the two customer bases will be migrated onto a single, unified network.

The two companies have complementary spectrum assets that will support LTE build-outs. Even more significantly, due to MetroPCS’ traditional focus on densely populated areas, the spectrum is very valuable as it strengthens T-Mobile’s network in the areas where the demand is greatest. T-Mobile estimates that by the end of 2015, the two customer bases will be migrated onto a single, unified network.

T-Mobile has been on a positive path for the past year in terms of foundational moves: the failed merger with AT&T resulted in T-Mobile being given spectrum; subsequently in July T-Mobile gained more spectrum from Verizon Wireless as part Verizon Wireless’s deal to acquire the Cable Company spectrum. And finally, just last week, T-Mobile gained $2.4 billion from leasing its towers to Crown Castle.

One sticking point with the proposed merger is the technology incompatibility issues: T-Mobile is GSM based, while MetroPCS is CDMA. A few years ago, this would have been considered a deal-breaker, particularly after Sprint demonstrated just how hard such a merger was with the Sprint/Nextel deal. However, both networks are migrating to LTE, which makes the technology issue far less painful. Indeed, MetroPCS already has a substantial LTE build-out. Again, the most important component is LTE-oriented spectrum: the technology is a far lesser issue. Further, according to MetroPCS, 60-65% of its customers switch devices every year, and when the devices are swapped out, the new ones will be based on the T-Mobile oriented spectrum and network.

The focus of the new T-Mobile is to continue on its current focus of becoming the “leading value provider.” This translates into continued (and increased) focus on unlimited plans, and specifically the recent move to offer unlimited 4G data plans. T-Mobile typically had two major competitors, with Sprint already offering unlimited data plans (although the Sprint “4G” is more limited) and MetroPCS targeting consumers at the more focused “value” end with unlimited plans. As such, the merger removes a thorn from T-Mobile’s side and turns that thorn into a major asset.

A side impact of the merger is the pressure that this adds to Leap Wireless and other regional players. Traditionally, Leap and MetroPCS offer similar market positions and have often been compared very closely. Indeed, many have considered that a merger of the two companies would make sense in the longer term but this is clearly no longer possible. Rather, the new T-Mobile leaves Leap, and others, like U.S. Cellular looking more vulnerable and open to acquisition rumors and activity.

We can expect to see more acquisition activity over the next 12 months. But again, the most important component here is that deals are focused far more on spectrum assets than on subscriber numbers. According to a recent Connected Intelligence report Need for Speed: 4G, the lack of available spectrum is a major limiting factor to mobile market expansion.

Of course, the merger will be far from smooth sailing. While we expect no significant issues with the FCC and DoJ, there will be aggressive competitive activity. Sprint, and its various prepaid brands (Boost and Virgin specifically) will aggressively target the MetroPCS base, positioning its own plans and options are a comparable solution. With MetroPCS having a no-contract base, there is always a far higher risk of churn in such a situation.