In 1995, The Economist Newspaper Group launched the world’s first web-only publication, a hi-tech-focused magazine called d.Comm. The magazine basked in a short-term glow of being an innovator, blazing a futuristic trail, and then closed its doors due to a lack of advertising. Simply put, blazing a trail alone is a dangerous business that has a very low success rate.

Since that time, the market has evolved in huge leaps and bounds, with a plethora of web-only successes and an advertising model that just about keeps up with the array of magazines and blogs vying for attention. Further, the market has evolved from a web-only solution to one that includes (and possibly dominated by) apps, which further helps drive stickiness to a brand.

Even in the mainstream market, the web/app presences of the major-league publications, such as WSJ.com, NYT.com, have proved to be a useful addition to the more traditional paper-based publications and, in a few cases such as The Huffington Post, the online model has become the standard presence. But much of this web/app presence has been either a free service, or as a way of maintaining paper-based circulations (full online access is only available to paying customers of the paper product).

Which leads to Newsweek, and its announcement today that it will close the paper-version by the end of the year, re-emerging as Newsweek Global in an online-only format. Is Newsweek’s decision to shutter its paper-based publication a bold evolutionary step, or one of desperation? Paid circulation for Newsweek has halved in the past decade, and advertising revenue has slumped even more rapidly. At the same time, Newsweek has only 26,394 paid electronic subscriptions, compared to 1.2 million paid print copies over the past 12 months, which is hardly a glowing validation of the proposed move. It suggests that the leap to the online-only world may be one of faith, rather than fact.

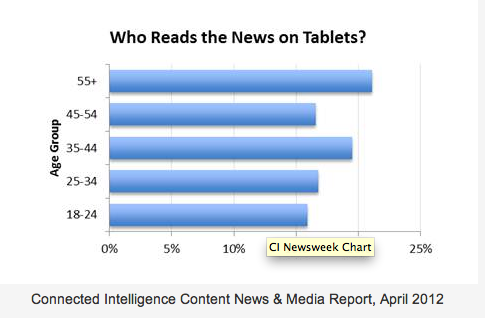

Newsweek is putting its hopes in the increasing number of tablets in circulation, and the fact that more and more consumers view the news online. But none of this necessarily translates to a willingness to pay for online news. The Connected Intelligence News & Media Behavior Report highlights that only 19 percent of tablet owners view news content on tablets, with a bias towards men versus women (23 percent to 16 percent). And this is not necessarily paid subscriptions, but rather is any news services. Indeed, looking at metered data on smartphones as an indicator, the top “news” apps are news-readers and aggregators, such as Flipboard, Google and Pulse News, not the paid publications themselves.

While Newsweek may have little choice but to abandon the paper-based past of the last 80 years, it is certainly embarking on a trial-blazing future. Yes, dropping the paper production will lead to significant savings, but it is very unclear as to whether an online future will drive revenue and subscriptions to a level that drives profitability. For many, the weekly newspaper format remains something that should be a physical product. On average, 45 percent of non-tablet-reading consumers state that the physical nature of the media is why they remain a disconnected media user. Unless Newsweek can convince this audience of the benefits of a new online version, through innovations and personalization options, then they online-only foray may match d.Comm’s experience.