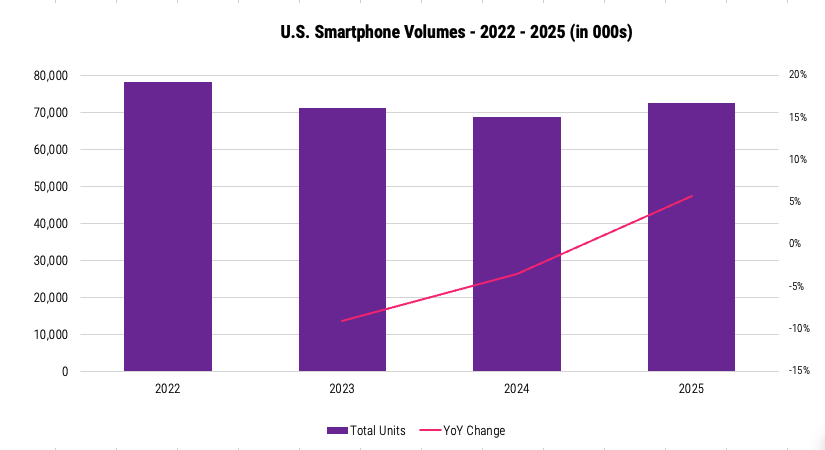

In 2025, new U.S. smartphone sales reversed the multi‑year pattern of declines, delivering the strongest annual performance since before the pandemic. Total volumes rose 6% year-over-year, a notable turnaround from the close to double‑digit drops seen in 2023 and 2024. This rebound aligns closely with expectations set throughout 2024, when the average smartphone age hit an all‑time high and signaled an inevitable wave of deferred replacements coming back into the market.

Growth was driven primarily by the postpaid segment, where smartphone unit sales climbed 7% for the year, outpacing the broader market. Carriers leaned heavily into aggressive promotional campaigns aimed at pushing subscribers off legacy rate plans and onto premium bundles, a strategy that successfully stimulated upgrade activity.

As in prior years, Apple remained the dominant force in the U.S. smartphone landscape. The company accounted for nearly two-thirds of all new smartphone sales in 2025, and its annual volumes rose 10%, surpassing overall market growth. Samsung, still the leading Android flagship brand, faced a 5% decline in annual unit sales, reflecting competitive pressure from both Apple and challengers like Motorola, which posted a substantial 22% jump in annual sales, buoyed by its dominant position in the sub‑$300 category. Google Pixel also delivered healthy growth, with volumes rising 13% year-over-year, driven by continued gains in brand awareness and strong reception of its newest AI-forward models.

Looking ahead, the positive momentum is expected to continue into 2026. Elevated device age will remain a key demand driver, as millions of consumers who delayed upgrades during economic uncertainty now face aging hardware and diminished battery performance. At the same time, postpaid carriers are likely to sustain aggressive promotional activity on smartphones to enhance the attractiveness of their converged home-and-mobile internet bundles.