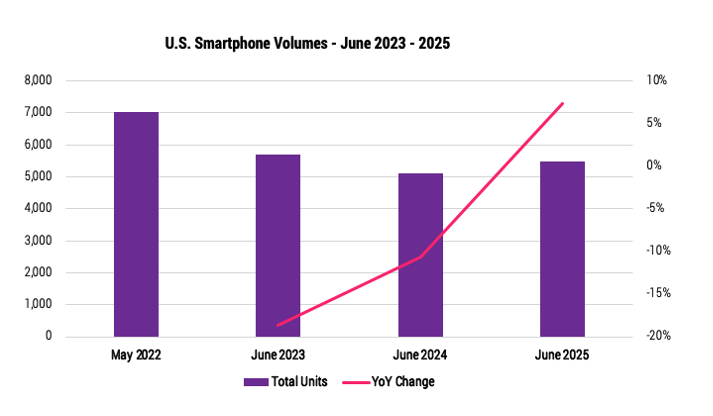

In June, the growth trajectory in U.S. smartphones persisted, driven by tariff-induced price hikes that prompted consumers to pull-forward their smartphone purchase before the tariff began. While total smartphone volumes experienced a 7% year-over-year increase, this growth failed to offset the 11% decline observed in June 2024 and the 19% decline in June 2023, respectively.

Both Apple and Samsung experienced a 9% year-over-year increase in smartphone volumes in June. Notably, the regular iPhone 16 emerged as the top-selling smartphone, followed by the pricier Pro Max and Pro versions. These three phones collectively accounted for a quarter of all smartphones sold during the month, contributing to a 13% jump in total smartphone dollar sales (MSRP-based) compared to the previous year. This sales surge can be attributed to demand pull-forwarding, as ongoing news coverage about potential (tariff-driven) price increases for new-generation iPhones set to be launched in September prompted many consumers to make purchases earlier. Additionally, postpaid carriers’ strong promotions, particularly those tied to high-end subscription plans, continue to drive volume for Apple.

Samsung’s volume growth in June was primarily driven by its low-end Galaxy A15 and A16 models. These 5G-powered phones remain the top sellers in the competitive prepaid market. However, Samsung’s volume mix is poised to undergo a significant shift in July due to the high demand for its new foldable models, despite their relatively high price tags. Interestingly, Google led the market in volume growth, with a 26% increase over June 2024. This growth was fueled by the strong performance of the Pixel 9 phone, which was offered at an affordable price of $249 at the small-scale prepaid carrier US Mobile. Despite the sales boost, Pixel’s market share remains relatively small compared to its rivals, Samsung and Motorola.