Mobile phone trade-ins have rapidly moved from being an obscure option to one that is front and center at the major carriers. The shift comes as the carriers look to move away from the subsidy model – led by T-Mobile’s “Uncarrier” initiative, but also by the increased demand for no-contract variations as the market hits a new level of maturity.

The trade-in concept is gaining consumer traction rapidly, with over 60 percent of smartphone customers aware of trade-in options, according to The NPD Connected Intelligence Trade-In, Trade Up, Trade Out report, which examines consumer attitudes to the trade-in options. But with this awareness come risks, and opportunities, for retailers and carriers alike. Roughly 30 percent of respondents are willing (top two box ratings) to switch carriers in order to gain a better trade-in value, suggesting that carriers need to get the trade-in values right if they want to maintain consumer loyalty. Further, over 60 percent of respondents are willing to change retailers (but not necessarily the underlying carrier) in exchange for a better trade-in value.

This is great news for the retailers looking to carve out a larger share of the wireless retail market and sets the stage for a new level of pricing competition. Notably, the retailers benefit from their existing trade-in programs, which support all consumer electronics, not just mobile. A consumer could, conceivably, trade-in an old game console in return for a credit towards the latest and greatest smartphone.

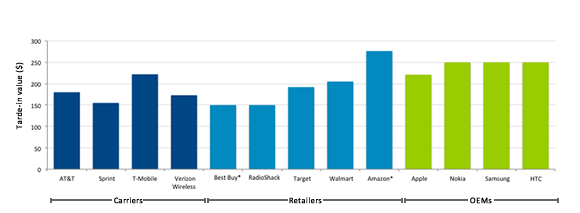

And the manufacturers are grasping the trade-in opportunity too. For a smartphone manufacturer, a trade-in option can provide an incentive for a consumer to switch loyalty from a competitor’s device to theirs. Notably, nearly all manufacturers offer a premium price to consumers who trade-up from a competitive brand. Take the chart below, which provides a snapshot of trade-in prices offered for an Apple iPhone 4S 16GB (AT&T version). Nokia, Samsung and HTC all offer above-average trade-in values, as long as the new device is (of course) that OEM’s device.

Source: The NPD Group Connected Intelligence Mystery Shopper July 2013

All this means that, potentially, the carrier grasp of the smartphone consumer could become more tenuous. And it is primarily for this reason that we’ve seen a flurry of trade-in activity in the past month. The launch of Jump, Next, and Edge from T-Mobile, AT&T, and Verizon are all aimed at providing an easy upgrade path for consumers, with a relatively certain exchange rate. But the cat may be well and truly out of the bag and the competitive landscape for trade-ins will drive many consumers to consider their options more carefully moving forward. And there is a whole new round of potential trade-in customers being added to the market. According to NPD’s Mobile Phone Track, 40 percent of smartphone buyers in the 12 month period ending in June were first-time smartphone users. So while they would not have been a prime target for trade-in programs this time around, they will be when it comes time for a replacement. Market awareness is increasing, and the trade-in options are certain to become more compelling as the ongoing battle for consumer loyalty continues.

Click here for more details of the Trade In, Trade Up, Trade Out innovation report.