The initial fanfare of last week’s Apple announcements has subsided and the debate has moved from what will be announced to which device consumers will purchase. What we have seen so far from data collected by market intelligence company, CivicScience1, is that consumers are fairly divided. The iPhone X is obviously the flagship product and, more importantly, the one that stands out as being different from the others, thanks primarily to the full glass body (yes, there are differences beneath the glass, but the reality of consumer interest is more skin deep), but at $1000+, there’s a price to be paid for such cachet, even when leveraging today’s carrier offers.

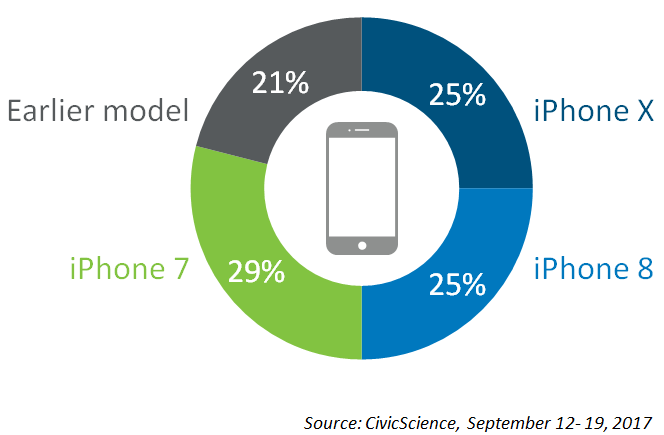

Consumers that intend to purchase a new Apple device following the announcement indicated they will buy…

According to the CivicScience results, roughly 20 percent of the U.S. population plans to purchase a new iPhone following Apple’s announcement. That’s a lot of iPhones – equating to roughly half of Apple’s U.S. iPhone customer base, or potentially over 60 million devices in the next three to six months. But the numbers (and remember that these are intent, rather than actual purchases) are not out of the ordinary for Apple, which commands a 41 percent share of the total smartphone installed base in the U.S, according to NPD’s Connected Intelligence2. As such, this appears to be the relatively standard fare of upgrades, rather than new consumers switching allegiances from Android.

And there’s a catch: the Apple intender base is fairly evenly split between which device they plan to purchase, with the X and the 8 commanding equal interest at 25 percent of those planning to purchase a device, and the iPhone 7 showing slightly more interest at 29 percent (older models are also showing significant interest, with pre-7 models commanding 21 percent of the population’s intent). To put it more simplistically, over half of those intending to buy an iPhone fairly soon are looking at older models, rather than the newly-announced devices.

This should not be unexpected. When the fresh new shiny models launch each year, the older models drop in price, both due to carriers trying to shift older inventory (if they haven’t already) and prepaid carriers jumping on the older options as a way to drive consumer interest in their service options. In other words, just as there is a raging battle among the top four postpaid carriers to retain and entice new customers with Apple’s latest and greatest, so too is there a lower-tiered fight among the prepaid carriers.

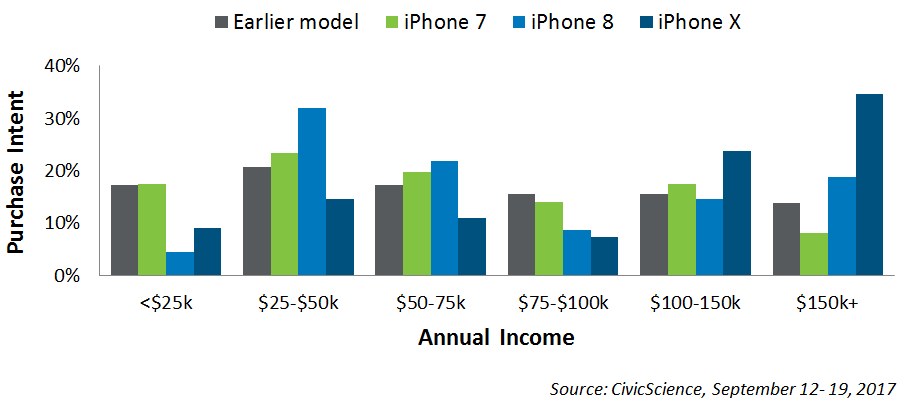

Related to this is the clear fact that income levels impact the amount of disposable income available to buy the latest and greatest smartphone, regardless of brand or capabilities. So it’s hardly surprising that the consumers who are most likely to purchase the X are in the higher income brackets, while lower-tiered incomes are more likely to choose the 8… or the 7. But, there’s also clearly a pent-up demand for even earlier, cheaper models with pre-7 models commanding just as much intent as the 7 for many of the income brackets.

This is a mixed blessing for Apple. On one hand, it does show a strong loyalty to the brand, but on the other hand, the older models are going to struggle, over time, to keep up with the demands of the latest apps and features, meaning that the consumer experience won’t be as slick and smooth.

The divided consumer base offers an opportunity for carriers:

1. To bolster the demand for newer models, it’s pretty clear that consumers need a lower price point, or at least, lower monthly payments. The sticker shock of spending $1000+ on a new device is quickly alleviated when the “real” price is less than $50 per month over 24 months, which is why 65 percent of consumers planning to purchase an iPhone intend to make use of a payment plan, rather than looking to pay all at once, according to data from CivicScience.

2. To broaden the market further, tempting consumers away from the older models, carriers should consider adding a 36-month option to the Equipment Installment Plans (EIP). Not only does this make the purchase more palatable to the consumer, but it also helps the carrier to retain the consumer for a longer period of time. In theory, the EIP is not a contract, but it’s a lot harder to switch when your device isn’t paid off. As such, there’s a win-win for Apple and the carriers that’s looking more plausible than ever before.

1Source: CivicScience surveyed 2,000 U.S. adults from September 12- 19, 2017.

2Source: NPD Connected Intelligence, Mobile Broadband survey, July-August 2017.