Warner’s licensing initiative

Warner is freeing its exclusive content and icon brands such as Batman, licensing the programming to competitors instead of retaining it for HBO Max. Of note, Lord of the Rings was just licensed to Amazon to complement the company’s launch of their new TV series. Warner has been down this road before, selling its TV shows to other networks and now, after a hiatus, are again giving it another go. This may make sense as some of this content has been sitting on the shelf. At this juncture it’s unclear if there will be a window for licensing as new programming such as Batman: Caped Crusader is also being shopped to key competitors such as Netflix. In sharp contrast, Disney has spoken openly about their past licensing deals with Netflix having been a critical mistake. Granted, Disney is known for “The Vault,” having used built-up demand to generate revenue through re-releases of their iconic library.

The NPD Take:

- The Disney - Warner Bros. Discovery experiment will be closely watched as network and studio executives are wrestling with quantifying the value of retaining exclusive rights vs. lucrative non-exclusive licensing deals.

- Disney’s approach is clear; the content arm is there to fuel Disney IP expansion and content distribution. Non-exclusive distribution, when also managing a DTC streaming service, is trickier as the justification for when and when not to retain exclusive rights remains grey.

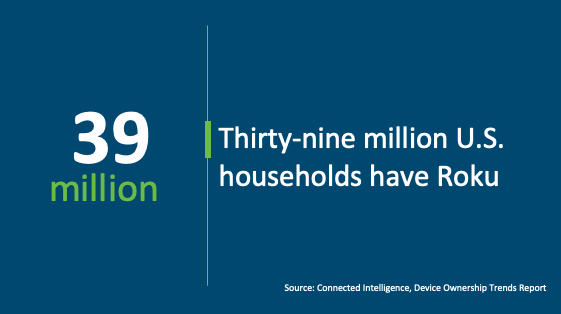

Walmart and Roku team up

Walmart will be partnering with Roku to offer streaming customers a new way to buy select products that will be fulfilled by Walmart. Advertisers will place products on the TV screen for users to simply click and buy. It’s very simple for users – just two clicks of “OK” on the ad and checkout page and they are done. The checkout page will already have all their payment details shown from Roku Pay. Roku will use its proprietary software Oneview to measure and track the users experience with the ads. This is the first time this is being done and offers direct benefits to advertisers enabling them to gauge ad effectiveness. Roku customers also benefit by the convenience of one stop shopping on their TV.

The NPD Take:

- This opens a new area for retailers and advertisers to use TV operating system partnerships to reach customers and increase sales.

- This has the potential to provide streaming TV platforms another avenue to generate revenue from their household base.

'Thursday Night Football' touchdown

Amazon reported record Prime signups during their debut of Thursday Night Football. That is, more people signed up for Prime during this event then from the company’s other massive shopping events such as Black Friday, Cyber Monday and Prime Day. It didn’t hurt that it was a competitive matchup between the KC Chiefs and SD Chargers. Amazon did not reveal the number of viewers, but they expect about 12M weekly viewers from Thursday Night Football (TNF). Last year, Amazon secured the streaming rights to TNF for $1B annually, which includes 15 regular-season games and one preseason game per year. TNF had its best season last year since 2015, averaging over 16m viewers.

The NPD Take:

- The messaging from Amazon shows that Prime Video, in large part, is seen as a conduit to procuring Prime subscribers, a key measurement of success for licensing deals.

- We’re continuing to see the high value of sports to streaming giants, as such, don’t be surprised if we continue to see content distributors overpay for sports rights to grow their subscriber bases.