Disney purges almost 100 titles from D+ and Hulu.

Recently, Disney underwent its first-ever content purge across both Disney+ as well as Hulu in a cost-saving measure. Roughly 100 titles were removed across the two services and included originals as well as licensed titles; movies as well as series. To be fair, none of the removed content was blockbuster status (the most popular title was likely a series reboot of the 80s classic movie Willow, which was cancelled after its first season). But it's hard not to raise an eyebrow at the decision to remove any content, even underperforming content. The move makes clear that the win-at-all-costs days are over and profit is once again the driving force in the decision-making process.

The Circana Take:

- Removing content is a careful balance between saving on licensing fees and residuals from subpar content while also avoiding abnormally high churn.

- The harder part may be on the perception front. While this is certain to save some capital, how desperate of a play does it seem to be, and will the userbase remain faithful to the remaining content?

Netflix reveals long-anticipated password-sharing rules.

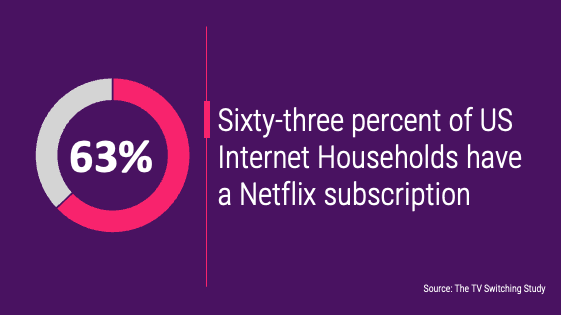

The long-anticipated move by Netflix to begin enforcing its password-sharing protocols began in earnest on May 23. Netflix is looking to convert some of the estimated 100 million account borrowers to a subscription plan by enforcing a 'household-only' policy for a given account. Account owners can add the additional member for $7.99/month, or that user can sign up for their own account starting as low as $6.99 per month with ads, or $9.99 without. Overall, the AVOD offering generates higher ARPU for Netflix, and the password crackdown is seen to be more likely to generate new subs versus having the account holder add a single profile to their account.

The Circana Take:

- Netflix needs to re-establish growth in the domestic market while also managing churn. Balancing turnover from this change versus the expected incremental growth could be a historical inflection point for Netflix.

- Already the biggest streamer in the world, growth seems inevitable if their estimates about the size of the sharing market are accurate. But that's a big if.