Verizon set to bundle Netflix and Max.

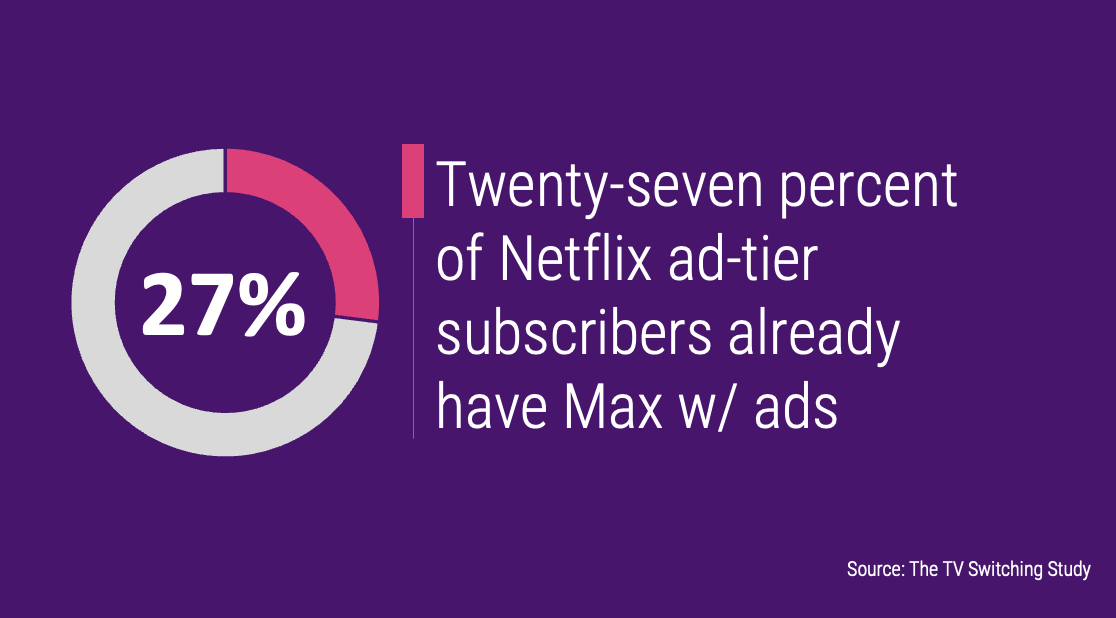

Netflix and Max will soon have their ad-supported offerings bundled together for Verizon’s myPlan wireless customers. The Wall Street Journal reported that the cost per month will be around $10, a sizable $7 discount from the a la carte versions. It is the first time that Verizon will support the ad tiers for each streamer, and the bundle will be made via Verizon’s +play streaming aggregator. Each service will use its own login, allowing customers to use their subscriptions across all supported devices.

The Circana Take:

- As profitability takes center stage in the streaming universe, bundling offers a win-win to both sides. Customers gain access to more content for less expense, while Verizon, Netflix, and Max stand to reduce churn through the combined offering.

- We are entering a new phase in the streaming ecosystem where companies will look for more creative synergies to reduce churn, thereby increasing profit.

Warner Bros. Discovery reports mixed Q3 results.

Overall revenue was up and year over year and losses were down for the third quarter but declines in ad revenue sent WBD stock downward. Global streaming subscriptions fell slightly from 95.8M in the second quarter to 95.1M while domestically, Max lost 1.4M subscribers. This comes after a similar loss in Q2 of 1.3 million (UCAN). CFO Gunnar Wiedenfels cited a weak slate (likely due to fallout from the writers’ and actors’ strikes) as well as some overlap between Max and Discovery+ members. Despite the loss of subscribers, Max’s first full quarter as a combined streamer saw a modest profit. CEO David Zaslav said, “churn is the biggest issue we face,” and declared, “an all-on attack to reduce churn.” The addition of both CNN Max and the Bleacher Report both were “showing early signs of … lower churn on Max.”

The Circana Take:

- WBD continues to innovate in an effort to attract customers and reduce churn. From bundling deals to licensing content to other streamers and new value adds with news and sports. WBD has navigated its way to small profit as one of the top 5 streamers.

- Despite the strikes recently ending, the drag on content will take time to fully rebound, but that challenge affects the entire industry. How WBD decides to persevere through a persistent weaker slate may be its biggest hurdle regarding churn.