Netflix reports Q4 earnings

Netflix reported better-than-expected growth in almost all metrics, with a total user base now exceeding 260M global subscribers. Over 13M subs were added worldwide in Q4, with UCAN adding 2.81M subs, growing to over 80M. Revenue was up 12.5% to $8.8B, while operating margin was 21%, up from 18% in 2022. Executives cited three growth centers: a solid paid-sharing strategy, a steadily growing ad-tier, and a strong content slate.

Netflix also announced that it will be sunsetting the $11.99 Basic Plan, which will reduce the available subscription tiers from four to three: the ads tier is $6.99, while standard (HD) is $15.49 and Premium (4k) is $22.99. The Basic plan will be removed from Canada and the UK in Q2’24, with other markets under review. The move is expected to further accelerate migration to the ad tier (which yields higher ARM, or Average Revenue per Member), and currently has 23M monthly active users.

And, in a surprise announcement prior to the earnings call, Netflix announced a 10-year, $5 billion partnership with TKO (parent company of WWE and UFC) to distribute WWE’s flagship Raw program starting in 2025. The deal carries an option to continue for an additional 10 years as well as an out option after five years. Raw will air live, weekly in the United States, Canada, the UK, and Latin America, while international territories will get all WWE content, including premium live events such as WrestleMania, SummerSlam, Royal Rumble, and NXT, and any relevant documentaries. Netflix will also be permitted to develop original programming around WWE storylines and characters. Having aired for 20 years on the USA Network as Monday Night Raw, the reference to “Monday” was conspicuously left off of both companies’ announcements, implying that a change in airing day will be in play (likely to avoid competing against Monday Night Football). Some premium WWE content will remain on domestic networks and streamers in existing five-year deals.

The WWE Network will also be shuttered by the end of 2024, with all relevant content shifting to Netflix. "This deal is transformative," said Mark Shapiro, TKO President and COO. "It marries the can't-miss WWE product with Netflix's extraordinary global reach and locks in significant and predictable economics for many years.” The move is expected to attract a small but passionate user base, expand the WWE brand internationally, and grow Netflix’s ad revenue with a fixed, weekly program.

The Circana Take:

- Netflix further cements its dominant position in the streaming space with a massive fourth quarter and capping off a successful 2023. Netflix’s paid sharing strategy was successfully executed, and ads are slowly taking hold, while other initiatives like gaming are still in early days.

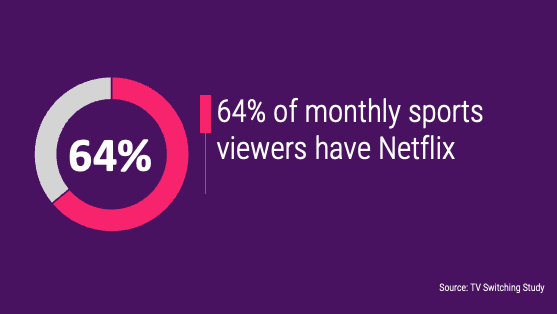

- Netflix’s deal with TKO to secure WWE rights certainly seems like a head-scratcher at first, but it will allow Netflix to learn on many fronts: weekly, live programming and the advertising surrounding this content type, a unique entry point into live sports entertainment, and the chance to grow a known brand internationally. This is not live sports (and Netflix said they are not changing their strategy on that front), but it should give them plenty of insight on how to enter that space should they choose to.