Hulu to begin crackdown on password-sharing.

Following in the footsteps of Netflix and sister-streamer Disney+, Hulu announced its intentions to begin cracking down on password sharing “outside of your primary household.” In an email last week, Hulu’s subscriber agreement was updated and affects new subscribers as of January 25, while the new rules take effect for existing subscribers on March 14. Enforcement details were not mentioned, but the expectation is that the move will generate incremental subscriber growth by forcing sharers to enroll in their own subscription plan.

The Circana Take:

- With revenue, and, more importantly, profit, taking center stage in the streaming landscape, it is no surprise that Hulu is looking to create the same type of growth seen by Netflix after they implemented similar policies.

Amazon launches ads on Prime Video.

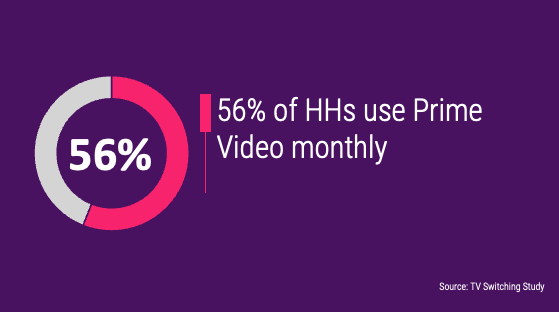

Amazon has turned the streaming industry on its head with a percussive entry into the streaming ads business. Why the hyperbole? Well, there are a couple reasons. First, Amazon has defaulted all subscribers into their brand-new ad tier (or pay $3 a month to turn off ads), while other streamers have built a separate tier for opting in to an ad-infused experienced. Second, Amazon has a substantial background in advertising, so the company’s experience and technical expertise will allow it to instantaneously leapfrog the competition in one fell swoop. Expectations are that Amazon’s new move will divert and capture over $800 million in ad spend from other sources. And revenue estimates for Prime Video with ads range from near a billion dollars to over $6 billion a year in revenue, depending on the source and the projection range.

What is not as well understood is the impact on Prime Video engagement. And that is especially hard to forecast, since Amazon has never publicly disclosed subscriber numbers. Some estimates place their viewing base near Netflix’s 80 million US households. But even if accurate, that number is still a best guess because Prime Video is built as a perk to Amazon’s Prime free-shipping subscription, so estimating actual viewership engagement as a subset of the entire Prime base is especially challenging.

The foray into ads is obviously meant to generate an immense amount of revenue, which Amazon says will be allocated to content spend. Amazon’s 2023 content spend ($18.9 billion, including TV shows, movies, and music) was meaningfully larger than streaming leader Netflix’s (a strike-diminished $12.6 billion, but projected to rebound back to 2022’s $17 billion). However, part of Amazon’s massive content spend is Thursday Night Football, estimated to approach $1 billion per year.

But wait! What about Freevee? According to Amazon leadership, Amazon’s FAST service is not going anywhere. So, Amazon will have FAST and AVOD, with an opt-up to SVOD, as well as channel subscriptions, purchases, and rentals.

The Circana Take:

- The decision to foist ads upon the entire user base comes at an interesting inflection point between subscriber fatigue, price sensitivity, and the desire to create a profitable streaming business. While Amazon will surely vault into the lead when it comes to serving ads, content discovery, viewing engagement, and ad tolerance will all play a part in the decision to continue as an engaged Prime Video subscriber.

- Since the underlying metrics are not public, Amazon’s promotion of their ads business will be hard to interpret. We do not know the subscriber count nor the engagement metrics, so estimating the success of Prime Video with ads will be especially challenging, and we may be left to take Amazon’s word for it.