Disney reports Q1’24 earnings.

For Q1’24, Disney reported a 1% decrease in UCAN (U.S. and Canada) Disney+ subscribers, from 46.5 million to 46.1 million, while SVOD-only Hulu saw a 3% increase from 43.9 million to 45.1 million. Average Revenue per User (ARPU) was up for both services, to $8.15 (+9%) for UCAN Disney+ and to $12.29 (+1%) for SVOD-only Hulu. The full integration of Hulu into Disney+ is slated for March, and the early metrics have been “beyond expectation” for Disney. Further, Disney expects streaming to be profitable by Q4’24. Losses related to streaming improved by “nearly $300 million versus the prior quarter.” Disney’s guidance for Q2’24 is 5.5 to 6 million new subscribers.

The Circana Take:

- Re-bundling is upon us. As such the pending combination of Hulu into Disney+ is expected to fortify that user base and minimize churn. Should Disney hit its guidance to be profitable by fiscal year-end, we may see a new inflection point involving subscriber growth coupled with profitability.

- The company is not just banking on product strategy, the 2024 Disney+ slate includes two brand-new Star Wars series, the first-ever Pixar Disney+ Original series, and a slate of animated titles from Marvel Studios. The combination of product integration and powerful programming has the potential to drive the forecasted profitability.

Disney announces major sports partnership with WBD and Fox.

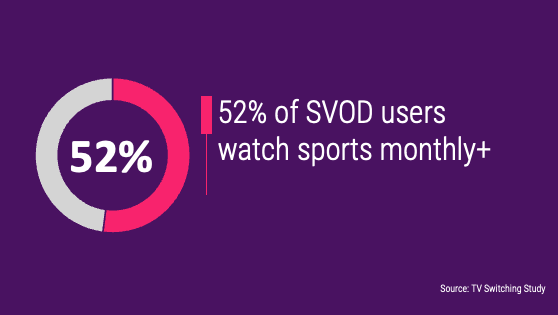

Disney, Fox Corp., and Warner Bros. Discovery announced a sports-focused joint venture that will see the linear assets of the three entities combined into a single, new streaming app on a non-exclusive basis. In doing so, the new app (no name or price was announced) will include fourteen linear channels and cover approximately 56% of U.S. sports spend. Channels in the partnership include linear assets from Disney (ESPN, ESPN2, ESPNU, the SEC Network, the ACC Network, ESPNews, ABC) as well as ESPN+, Fox assets (Fox, FS1, FS2, the Big Ten Network), and WBD assets (TNT, TBS, truTV). The new app will also be available to be bundled with Disney’s existing streaming services (Disney+ and Hulu) as well as WBD’s streaming service (Max). This will be the first subscription streaming venture for Fox.

No new content will be made under the new arrangement and ownership will be equal, while revenue will most likely be split according to current sports rights share and respective channel valuations. If true, revenue splits would mean that Disney would capture around 50% of revenue, Fox around 30%, and WBD around 20%. The collective CEOs of the partner companies have each said that the target audience is cord-cutters and cord-nevers, and that they do not expect this to materially affect existing cable and satellite customers.

The arrangement will include all of the NBA, NHL, and NCAA College Football Playoff, most of MLB, roughly half of the NFL, and parts of NASCAR, UFC, the PGA Tour, Grand Slam tennis, the FIFA World Cup, cycling, and a variety of other college sports. What will not be covered includes the remainder of the NFL, NCAA March Madness, the Olympics, some PGA coverage, as well as some soccer and college football. Most price estimates are around $40-50 per month, with a promotional offer near the $30 price point. The service is targeting a fall 2024 launch, just in time for college and NFL football seasons to start.

The Circana Take:

- This is a hedge against big tech and move to preserve/generate revenues as cord-cutting continues. Big tech has deep pockets and has become more competitive in the space (see Apple TV+ with MLS, Amazon Prime Video with Thursday Night Football, and YouTube with NFL Sunday Ticket). This joint venture keeps the revenue with the current rights owners regardless of how fast cord-cutting occurs.

- Sports streaming has become more expensive and confusing, and this joint venture will only fix one of those problems. By having one skinny sports bundle that covers just over half the market, it is likely that this new service will become the anchor to sports streaming. That said, this move is bound to cannibalize linear.