Walmart buys Vizio for $2.3B.

Earlier this month, Walmart announced a bid of roughly $2.3B for budget TV maker Vizio. However, the hardware is barely the focus of the story. Vizio’s major value to Walmart is in its operating system (SmartCast) and its FAST network (WatchFree+), which collectively boast about 18 million accounts. This acquisition allows Walmart to expand its retail media network (Walmart Connect) to further enhance its advertising reach by entering the Connected TV (CTV) market. In doing so, Walmart will be able to take immediate advantage of SmartCast’s 18 million accounts. The company also has numerous growth opportunities for this highly profitable business segment.

First, Walmart’s own value TV brand (Onn) currently runs on Roku, so converting those units to SmartCast will mean more captured revenue as well as an ever-increasing user base upon which they can sell ads. More, Vizio’s CEO said that they have already been discussing licensing deals which would expand SmartCast’s reach. It seems prudent that Walmart would continue those discussions.

But wait, there’s more! This deal also helps to create a flywheel effect across its offerings: Walmart is America’s #1 retailer whose largest revenue source is groceries. CPG ad spend is second only to retail. Walmart Connect (Walmart’s in-house media arm, also known as a retail media network) will offer better attribution by owning both the ad-side (through SmartCast, which has glass-level data) and the buy-side (through Walmart’s retail presence). This will make the advertising they sell that much more valuable for potential marketers through both better targeting and better attribution.

The Circana Take:

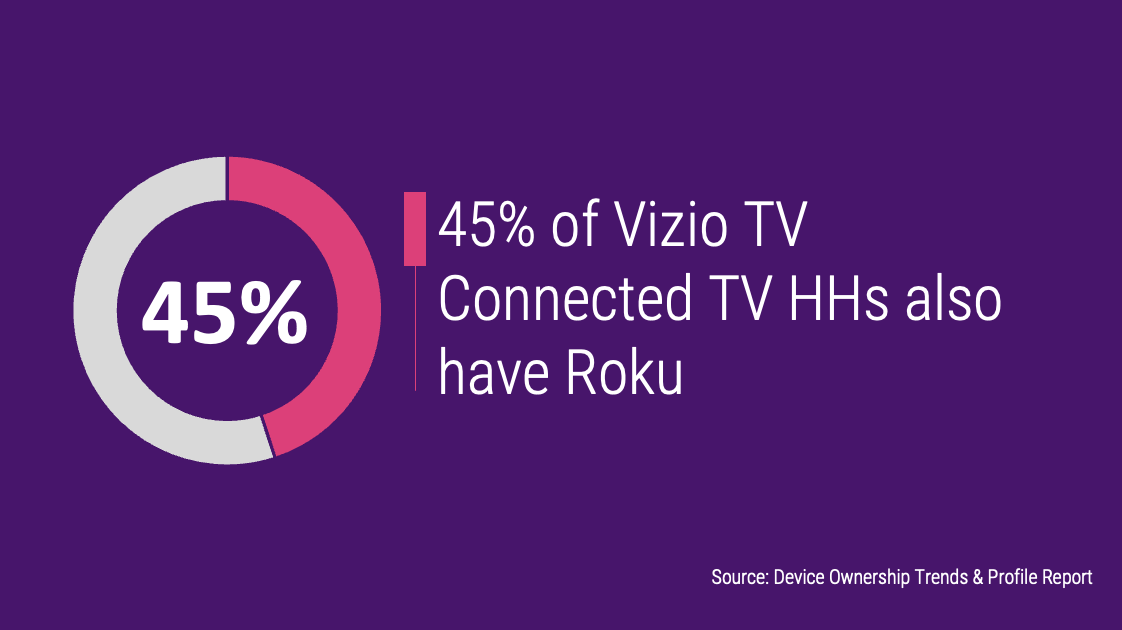

- This has everyone in the ad world talking, since Walmart wasn’t on anyone’s bingo card to disrupt the 2024 ad market, but here we are. Roku is the most likely to raise their eyebrows. Roku, which has dominated share of TV OS for years, stands to lose share to the new Walmart/Vizio deal. Roku most recently had about 25% share to Vizio’s 12%. For Amazon, which dominates the advertising model Walmart is trying to replicate, they have less of an existential concern and more of a competitive one. With Amazon’s recent move into streaming ads, many see the Walmart/Vizio deal as a response to the general changes to the ad landscape.

- Simply put, reach is revenue. It behooves Walmart to drive reach of the SmartCast OS as quickly and efficiently as possible. Partnering with new hardware OEMs (e.g. Hisense, TCL), installing their new software on their own hardware, and expanding their footprint through licensing deals are expected.