Propping up Pluto

Pluto TV grew to 24 million active users, up 55% year over year. The product recently received an updated interface, new features, and improved user experience. The service has also seen expanded distribution in the U.S. and internationally. Of note, the company struck a deal with Verizon to market PlutoTV to their wireless, broadband and video subscribers. And, PlutoTV now has one-click access as a part of TiVo’s own ad-supported video network, TiVo+. To further bolster its value, the service integrated company owned CBS Sports HQ.

The NPD Take:

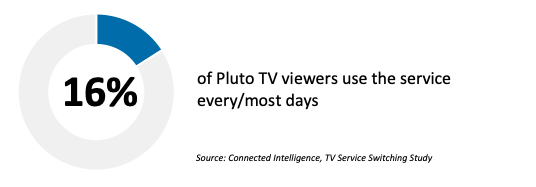

- Free streaming services such as PlutoTV are poised to replace basic cable viewing. But, there is a long way to go to establish the kind of daily usage generated through traditional pay TV services. For example, 16% of Pluto viewers use the service every/most days where 75% of Xfinity cable customers use the service daily.

- Integration with SVOD services is a likely next step. Bundling a fine tuned AVOD service with add-on channels such as Showtime will start to recreate the bundled TV experience of the 1970s but with the advancement that can be delivered through streaming.

Streaming prospers at ViacomCBS

The company just reported earnings and among the positive highlights were domestic streaming subscribers surpassing 13.5m, a year-over-year increase of 50%. CBS All Access and Showtime OTT delivered record subscribers, sign-ups and consumption. This was attributed to strong original programming, including Star Trek: Picard and Homeland. With more consumers at home, streaming platforms had their best month in April, with accelerated subscriber growth and consumption. CBS All Access and Showtime OTT sign-ups, daily average streams and minutes watched all rose substantially, versus the prior month. Positively, CBS All Access and Showtime OTT are seeing strong account activation, as well as consistent paid subscription conversion rates.

The NPD Take:

- COVID-19 stay-at-home orders have significantly benefitted SVOD services with many seeing increased sign-ups and usage. Real success will be measured through subscriber retention during the recovery as viewers become more socially active.

- New distribution deal such as those through pay TV Operators platforms like Xfinity X1 will further bolster subscriptions as consumers more apt to add “channels” through their operator will enter the mix.

Disney subscriber numbers skyrocket

Disney just announced new subscriber totals for the companies streaming services. Here’s the rundown. Disney+ now has about 54.5 million paid subscribers globally. Hulu ended the quarter with 32.1 million total subscribers (28.8 million SVOD only and 3.3 million live TV + SVOD). And, ESPN+ ended the quarter with 7.9 million paid subscribers. As with other media companies, they are benefiting from the transition to streaming, quickly cutting over their viewer’s and buyers to subscription offerings.

The NPD Take:

- Hulu Live TV is now the leading vMVPD with a critical mass of subscribers. With the payment infrastructure now built for Live TV, Disney+ and ESPN+ bundled promotions have the potential to keep growing the subscriber base.

- In the U.S. our new research (TV Service Switching Study) shows that as of April, one quarter of Disney+ subscriptions are free trials or promotions such as the Verizon Disney+ deal. This suggests that subscriber retention will be critical to long term success.