SVOD Earnings recap

Five of the seven largest SVOD services have recently reported earnings for the quarter ending March 30, 2024. Here are the headlines. (Note: Prime Video and Apple TV+ do not disclose subscriber numbers.)

Netflix

- Added 9.3m global subscribers (+2.5m UCAN)

- 269.6m global overall (82.7m UCAN)

- Ad tier grew by 65% in Q1

- Will stop reporting subscriber numbers in 2025: Executives on the earnings call said that subscribers are just one piece of the revenue puzzle, and also that global subscription tiers are now more diversified than ever, so the simple metric is less informative than in the past.

Paramount+

- 3.7m in the quarter

- 71 million total subscribers

- 51% year over year revenue growth

Peacock

- Added 3 million subscribers

- 34 million total subscribers

- 68% subscriber revenue growth

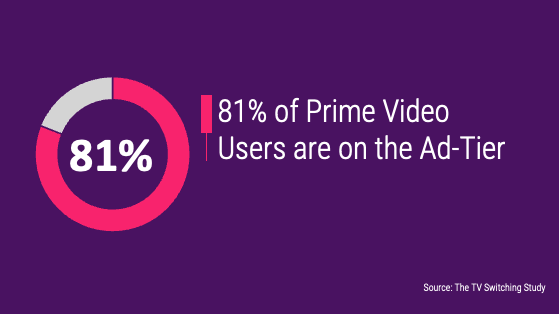

Prime Video

- 200m monthly viewers (this is different from subscribers)

- $11.8B in ad revenue, up 24% year over year, new Q1 record

Apple TV+

- Estimated to have 25 million subscribers

- Over $1B in paid subscriptions across all services (double that of four years ago)

- 23.9B in services revenue up 14% year over year

The Circana Take:

- When Netflix announced they will no longer report subscriber numbers beginning next year, it sent analysts into a brief frenzy. This is another indicator that revenue and profit, not subscribers are the metrics that matter.

- Amazon’s jolt to their ad business should be no surprise. They turned on ads by default for their entire Prime Video user base on January 29. Expect this trend to continue.