17-day window

It happened: the long-standing theatrical window broke and all it took was a pandemic. If you haven’t already heard, Universal Studios and AMC Theaters came to an agreement after a long stalemate. The theater chain will, again, exhibit the studios films. However, the 90-day exclusive has shrunk to 3-weekends amounting to 17 days. Granted, the theater can keep the film running and the studio may not cannibalize it by distribution the title through premium VOD. But they can and AMC will share in those profits.

The NPD Take:

- The movie studios have been evaluating a premium digital rental window for years. The closure of theaters and success of premium VOD proved the strategy could work. But will lightning strike outside of a COVID-19 stay-at-home environment? Likely for some, but not all programming. Determining which will, and the optimal window will be the new challenge.

- AMC Theaters is significant, but not the only game in town. Deals will need to be struck with the other theater chains too. A fragmented approach will confuse viewers.

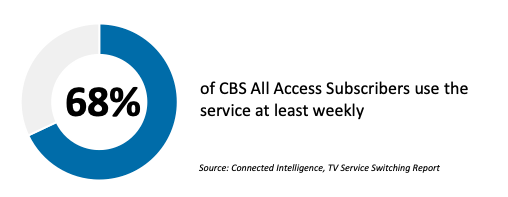

Re-inventing All Access

CBS was the first major network to launch a streaming channel way back in 2014. But their first mover position was leapfrogged by Disney, WarnerMedia, and NBC. Now that the organization has the content library of the combined ViacomCBS organization they are moving to reinvent All Access. Rebranding is coming soon, as well as a more robust programming array from the Viacom channels such as MTV. In the meantime, the company is adding 70 shows to the service. All said CBS has a larger content library than other networks and will focus on leveraging that for All Access as opposed to licensing competitors programming.

The NPD Take:

- The major networks, Disney, WarnerMedia, NBC and CBS have now become direct distributors of their own programming, all aggregated through a single app for each. Welcome to The Great Re-bundling.

- CBS appears to have realized the expanded service will need to drive revenue through increased ad-sales and subscriber growth, not a rate hike. Not yet at least.

Around 10m “sign-up” for Peacock

NBC’s Peacock streaming service moved from its Xfinity user base beta launch about 2-weeks ago and the company is starting to reveal metrics. As such, they reported around 10 million “sign-ups” to date. But that number is difficult to put into context as ad-supported streaming services, Peacock included, measure monthly active users and engagement levels as the core metrics of success. A sign-up simply does not equate to an active user. However, it appears to be a successful launch as the company cited they didn’t expect this many signups, this many people coming back as frequently as they are or this many people watching as long as they are. Indeed, they are restructuring to shift resources toward streaming and away from traditional TV operations.

The NPD Take:

- There’s the stay-at-home factor. Earlier in the pandemic that rate was in the ballpark of 50% incremental viewing versus pre stay-at-home viewership. While that has curtailed it’s not back to previous levels. As such, it could be part of what’s bolstering Peacock’s higher than expected launch numbers.

- The company won’t be able to avoid reporting a monthly active user base for long.