T-Mobile sharpens vision

T-Mobile is bringing its un-carrier philosophy to streaming live TV, offering three low-priced plans, initially, to T-Mobile (and legacy Sprint) customers, that has something for everyone. The lowest plan at $10/month, TVision Vibe, offers the most popular entertainment channels but doesn’t include live news or sports; sports or news junkies will need the $40 TVision LIVE plan to quench their thirst. T-Mobile’s move could help increase spend across its current subscriber base while enticing new customers to switch over to T-Mobile.

The NPD Take:

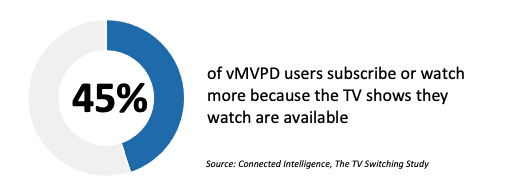

- By offering live streaming TV at very low price points and skinny channel offerings, T-Mobile is not only looking to compete with other vMVPDs whose offerings have increased in price substantially since they first launched but also drive new T-Mobile subscriptions while keeping their current user based more entrenched in their offerings.

- The TVision plan has to be viewed as part of a larger picture, which includes the carrier’s 5G to the home strategy. The combination of broadband (ish) to the home with streaming TV provides a more comprehensive package to shake up the existing cable-dominated world.

Baby Yoda saving grace

On the eve of Disney+’s first birthday, Baby Yoda is back in Season 2 of The Mandalorian. The first season was a huge breakout success for Disney and the company hopes that the release of Season 2 will convince its trial customers (such as Verizon customers who have had free access to the service for the past year), to convert to a paid subscription. With Disney taking a major hit this year thanks to the impact of COVID-19 on parks and theatrical revenues, the company is leaning heavily into Disney+ to ride out the storm. Hopefully Baby Yoda can save the day!

The NPD Take:

- Will The Mandalorian Season 2 release be enough to keep free trial subscribers interested in paying for the service or will we start to see increased churn for the streamer this quarter? The weekly release cadence could help tie over fans until WandaVision comes out in late 2020 and more new shows coming in 2021.

- Although original content drives trial and engagement, if there isn’t enough new programming being released due to production delays and increased competition from other services, consumers may start to rationalize their subscriptions. Keeping customers happy and engaged will be a challenge for all services in the coming months.

Redbox Free Live TV expands

Redbox continues to expand its Live TV service, more than doubling the channels since launch. Indeed, Redbox Free Live TV now offers over 75 channels, including music videos from VEVO with a goal to add 10 new channels every month. Additionally, the service is launching on Xbox One S and One X platforms, broadening its target audience. But it’s still going to be a tough push forward: with so many different services and channels, it will be difficult for consumers to know what they want to watch and what service it is on. AVOD could fall victim to quantity over quality and diluting the impact of potential ad revenue gains.

The NPD Take:

- As other competitive AVOD platforms tout significant gains this year, Redbox Free Live TV wants a bigger piece of the ad dollar pie. By increasing its content offering and expanding to other platforms, Redbox wants to ensure it has the content people want to watch and where they want to watch it.

- Discovery, differentiation and engagement are going to become increasingly more important among top AVOD players to maintain active usage that will help drive ad revenues.