WWE & Peacock tag team

Beginning March 18, WWE Network’s streaming service will be exclusively available through NBCUniversal’s Peacock. Peacock Premium subscribers will have access to WWE Network’s library of more than 17,000 hours of new, original content and all live pay-per-view events including WrestleMania and SummerSlam. Fastlane will be the first WWE pay-per-view to stream on Peacock on Sunday, March 21. Peacock Premium costs $4.99 per month, half the cost of a standalone WWE Network subscription.

The NPD Take:

- This exclusive deal will help broaden the appeal of Peacock. The price point and expansive non-WWE content will also help expand the WWE audience beyond its stagnant 1.6 million subscriber base.

- Look for more partnerships like this as The Great Re-bundling of TV continues.

Sling TV ups rates

Sling TV raised prices by $5 per month for new subscribers to the service, which will now start at $35 per month for the Sling Orange or Sling Blue packages or both packages for $50 per month. Existing customer prices will not change through July 2021 if their existing subscription remains active. The increased price comes with additional cloud DVR storage from 10 to 50 free storage hours and for the DVR Plus option, and from 50 to 200 hours for an extra $5 per month.

The NPD Take:

- Price increases have become common among vMVPDs, so this announcement comes as no surprise. Sling still offers attractive pricing vis-à-vis cable and other live streaming services like Hulu or YouTube Live TV.

- While competitors also raised rates, even higher than Sling, the company’s service has more content gaps which presents viewers with a price vs. content trade-off decision.

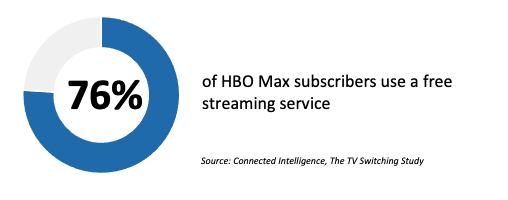

Ad supported HBO Max coming in Q2

AT&T announced an ad-supported, price-reduced option of HBO Max that will debut in the second quarter. HBO Max is currently priced at $15 a month, but AT&T has not yet disclosed pricing for their new AVOD tier. This is coming off 4Q growth fueled by a successful release of Wonder Woman 1984 thanks to the pandemic, coupled with Roku and Amazon Fire TV now offering app support for the service.

The NPD Take:

- Entry into the AVOD space should attract new customers and help expand HBO’s reach and revenue.

- Given the plethora of different OTT options available, AT&T will need to continue to create original and exciting HBO Max content that keeps consumers engaged and loyal.