AT&T TV launches nationwide

AT&T just announced the nationwide launch of AT&T TV, the company’s next generation pay TV service. It’s based on a highly customized Android TV set top box that fully integrates streaming video services like Disney+ with a traditional linear TV broadcast. The product is intended to be the company’s new work horse TV product. Intro pricing has been set low, very low, to encourage sign-up and while AT&T will not be encouraging switching from their other TV services, the pricing is built to prompt that behavior. That said, this is not a new vMVPD or streaming service. It requires a set top box, and two-year contract with rates that jump up in year two. This will not appeal to the current generation of TV viewers that have migrated to streaming. Indeed, this offering is all about using a best-in-class product to attract the critical mass of consumers that will want to keep a pay TV bundle and add-on the occasional streaming app.

The NPD Take:

- The pricing structure of the new work horse TV product appears designed to kill off the company’s vMVPD AT&T TV Now. The market for no-contract streaming linear TV services (vMVPDs) will now focus on the big three: Hulu Live TV, YouTube TV and Sling TV. We’ve been saying that 2020 would be the year where that market thinned out. The closure of PlayStation Vue and strategy change for AT&T took care of the initial step. Now there remain a couple of smaller players, FuboTV and Philo, that will need to find stronger distribution partners or be acquired.

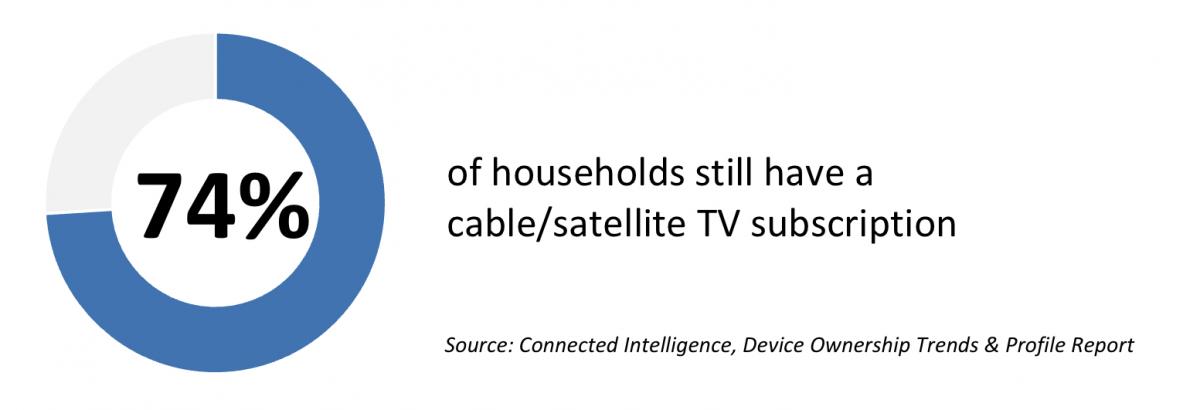

- AT&T TV is built for the 74 percent of U.S. households that still have a pay TV service bundle. While this base is declining, it will remain a critical mass of consumers. AT&T TV is offering this next generation video product, with lower operating costs, allowing it to operate profitably in the new era of streaming TV.

Comcast buys Xumo

About a year following Viacom’s purchase of Pluto TV, Comcast has acquired the competing AVOD service Xumo. Similar in nature, each service offers free streaming linear TV. Xumo also

builds branded AVOD apps for companies such as LG and T-Mobile. Their capabilities are a match for Comcast’s upcoming Peacock service which will include branded linear streaming channels with curated programming such as that from SNL. There are also rumors that Comcast is still in the market to buy, in particular, Walmart’s Vudu service which is a major competitor to their FandangoNow transactional-on-demand movie business.

The NPD Take:

- The mergers and acquisition spree seen in the past two years hasn’t ended as mega media companies focus on procuring the assets needed to operate in the streaming video age. Xumo will provide tech and talent to assist NBCs launch of Peacock.

- An acquisition of Vudu would bolster FandangoNow’s market position and provide free streaming video content licenses for Peacock. If the financial terms are right, the strategy aligns.

FandangoNow gets fired up

Fandango’s digital movie rental service increased availability through distribution on Amazon’s Fire TV devices. FandangoNOW was already among the top three transactional streaming services based on U.S. household TV-connected device reach. This expansion further increases reach to viewers looking to rent movies on their TV. However, Amazon isn’t keen on enabling service competition on their hardware platforms; as such this is a watch only app. That is, the transaction must happen elsewhere. Making the most of this app launch will mean finding a strategy to take the friction out of the transaction.

The NPD Take:

- Connected devices have become the new retailers, and so being available on the growing installed base of Fire TV devices is important. However, as with other providers, the FandangoNOW Fire TV app is for viewing only and will not support transactions as Amazon doesn’t want to enable competition for its own video store. This is significant as most FandangoNow transactions are rentals where the consumer will be less likely to rent on one device and then go to their Fire TV to watch it. It’s a lot easier to simply rent and watch through Amazon Video.

- Maximizing the potential of this Amazon partnership will come from taking the friction out of the transaction. A strategy to do that could involve rental through a voice assistant.