Samsung brings 5G to low-end

Samsung last week added a new model to its affordable Galaxy A franchise. The new phone, the Galaxy A13 5G, is Samsung’s most affordable 5G-powered phone launched for the US market to date. Powered by Mediatek’s Dimensity 700 silicon, the new A13 5G boasts a 50-megapixel camera, a 6.5” adaptive display with a 90Hz refresh rate, and a 5K mAh battery. The phone is priced at $249, and can now be purchased through AT&T for $6.95/month (in 36 installments). The Galaxy A13 5G will join T-Mobile’s 5G device lineup later in January 2022. Incidentally, the Galaxy A13 5G’s launch was accompanied by the new Galaxy A03, Samsung’s ultra-affordable model priced at $159. The Galaxy A03 will be available through all of the major carriers beginning January 2022.

The NPD Take:

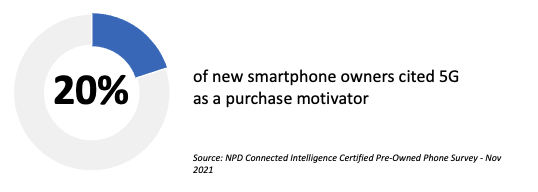

- Samsung adding 5G capability to its latest Galaxy A1x series model is a testament to the commoditization of the 5G feature, which rounds out the bottom in the list of device attributes driving the purchase decision. According to the NPD’s new Certified Pre-Owned market survey, only 20% of new smartphone owners cited 5G as a purchase motivator (compared to roughly 60% of them placing price and battery at the top of the list).

- Samsung’s price tags on the new A13 5G and A03 are proof points of the supply side and challenges boosting price inflation in global markets. The A13 5G’s predecessor A12 model launched with a $179 price tag, which is almost what Samsung is now charging for the low-end A03 model. The inclusion of the Mediatek-sourced 5G chip is not enough to justify the $70 price delta between the predecessor A12 and the new A13 models.

StraightTalk plans go unlimited

Verizon’s takeover of Tracfone has gone through all the official hurdles and the deal was finalized ten days ago. There are many questions around how Verizon will integrate the Tracfone brands and services into its postpaid-centric operation, but we have already begun seeing the impacts of the acquisition in Tracfone’s top brand StraightTalk’s service plans. StraightTalk mainstream $45/month, which came with 25 GB of cellular data now offers unlimited cellular data (deprioritization kicking at 60 GB). StraightTalk also upgraded its $60/month Unlimited International plan, which previously offered 25 GB of cellular data to an unlimited data offering. Notably, both plans now have reduced mobile hotspot buckets that went down from a 10GB allowance to a 5GB allowance per month.

The NPD Take:

- Rapidly growing cellular data consumption rates have been putting a lot of pressure on the MVNO business model (minus the cable providers that have Wi-Fi offloading capabilities), thus limiting MVNOs, such as Tracfone, ability to be aggressive with unlimited data offerings, which are common among prepaid brands owned by the network operators. StraightTalk’s amplification of its data buckets must be a direct result of the network support provided by its new parent Verizon.

- The crippling of the mobile hotspot data buckets can be a part of a long-term strategy as Verizon is keen on expanding its fixed wireless access (FWA) footprint, and the newly acquired Tracfone user base is a prime target for this new broadband-rivaling service. Heavy users of the mobile hotspot feature are more likely to be in non-Internet households, giving Verizon (via the Tracfone brands) the opportunity to push its new FWA broadband service.