Total Wireless goes under the Verizon umbrella

Verizon has, for years, trailed behind major rivals in the race for prepaid, and has hoped to bring an end to end by acquiring Tracfone. One year after the acquisition, Verizon has made its first major branding move by officially renaming Tracfone’s Total Wireless brand as “Total by Verizon.” We have previously reported on this expected move back in early June when information surfaced on Verizon’s trademark filing for the Total by Verizon name, and come September, Total by Verizon is up and running. Verizon has changed Total’s green color scheme to the Verizon red color and made slight modifications on the service plans front. Total’s lead $50/month unlimited plan offer now offers customers unthrottled and unlimited high-speed data (versus 25 GB of high-speed data prior to the rebranding) as well as a six-month free Disney+ subscription. Total by Verizon added an upper tier $60/month plan which offers free access to Disney+ with active service subscription and doubles the $50/month plan’s 10 GB mobile hotspot allotment to 20 GB. Further, Total by Verizon offers each additional line (on all plans) for $35/month. There are also two entry-level plans offering 5GB or 15GB of high-speed data priced at $30 and $40 per month.

The NPD Take:

- Total Wireless has become the second Verizon prepaid asset to under the Verizon branding umbrella as the carrier previously rebranded its own Visible MVNO as “Visible by Verizon” back in June. The Verizon brand reinforcement should help change the profile and perception of the Total Wireless service, especially in distribution centers (such as Target) attracting more affluent consumer groups.

- Total Wireless is not the flagship brand in Tracfone’s arsenal in terms of base size or consumer income demographics. The Walmart-exclusive StraightTalk brand accounts for about half of Tracfone’s total prepaid connections, and more importantly, attracts a slightly wealthier crowd (according to NPD Mobile Consumer Track, 60% of StraightTalk’s customers base have a household income of under $50K versus Total Wireless, which has 69% of its base making under $50K). We believe that the StraightTalk brand will eventually be subject to the same rebranding exercise assuming the rebranded Total by Verizon unit proves to be successful.

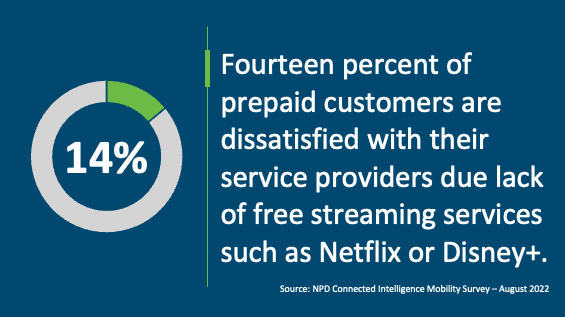

- Verizon previously extended its Disney+ content bundle to the Verizon Prepaid customers, thus seeing the Total by Verizon having access to the same bundle was expected. This is a notable extension as prepaid customers over-index (14% versus 10% among postpaid customers) for showing dissatisfaction with their carriers due to lack of free subscription to content services such as Netflix or Disney+.