StraightTalk jumps on the FWA Bandwagon

Verizon-owned Tracfone’s flagship brand, StraightTalk, made the headlines last week as it announced its foray into the 5G Home Internet market in collaboration with Walmart, StraightTalk’s long-time exclusive distribution partner. Walmart customers who reside in areas where Verizon has the 5G coverage (with fallback to 4G LTE) can now subscribe to the service through Walmart stores (nearly 2,000 stores per Verizon’s announcement) as well as through Walmart and StraightTalk’s online channels, after eligibility confirmation. StraightTalk’s white cubic-designed 5G/LTE FWA (fixed wireless access) router is available for $99, and customers can enjoy download link speeds that range between 20 and 100 Mbps for $45/month with no contract obligations.

The NPD Take:

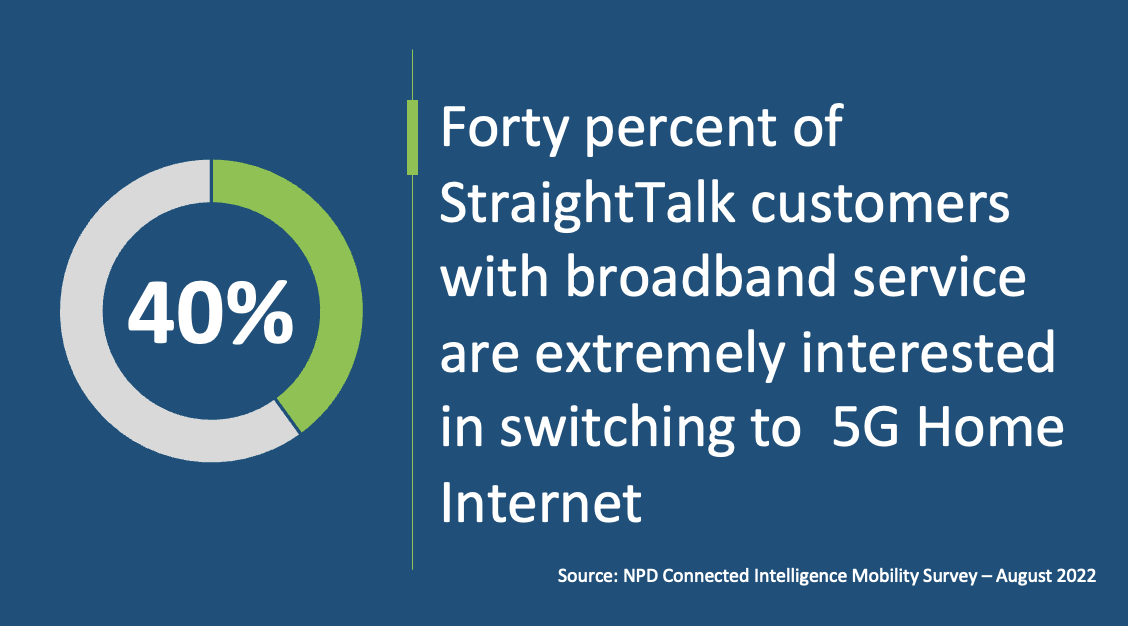

- Verizon’s debut of a prepaid 5G Home Internet service under the StraightTalk should help boost the carrier’s FWA user base, considering the prepaid brand’s positioning and large base at Verizon. According to the latest NPD Connected Intelligence Mobility survey, StraightTalk customers significantly over-index in interest for affordable 5G Home Internet solutions as a cable Internet alternative (40% of StraightTalk customers who have cable Internet subscriptions are “extremely” interested in switching to a 5G Home Internet service versus 24% t0 31% extreme interest at rival prepaid carriers).

- StraightTalk’s $45/month service fee is competitive versus rival Metro by T-Mobile’s $55/month plan, which drops to $50/month after the autopay discount. On the other hand, Metro offers its 5G router for $49 (versus StraightTalk’s $99 price tag on its router) in addition to a free month promotion. Notably, the pricing should be highly attractive for StraightTalk customers participating in the FCC’s Affordable Connectivity Program, which offers qualified consumers up to $30/month discount in their broadband Internet bills.

- Verizon, like T-Mobile, promises downlink speeds of 20 to 100 Mbps for its 5G Home Internet service. These committed speed levels should be satisfactory for most use cases, but as revealed in the latest NPD Connected Intelligence Mobility survey, consumers who lack enthusiasm for cable alternatives such as FWA solutions, are concerned about data speeds and reliability. StraightTalk and Walmart need to provide assurance addressing potential users’ concerns regarding connectivity.

AT&T and Verizon’s Q3 financials are in

AT&T and Verizon last week announced the results of their financial and operational performances for the third quarter. As in the previous quarters, AT&T was the first to take the stage, announcing another stellar quarterly performance with 964K postpaid net adds, 708K of which were postpaid phone connections. On the other hand, AT&T saw its postpaid churn rise slightly from 0.75% in the previous quarter to 0.84% in Q3 2022 (also up from 0.72% in the year-ago quarter). AT&T also enjoyed a prepaid base increase of 141K connections, 108K which were phone service subscriptions.

Verizon, on the other hand, had another troublesome quarter and would have posted significantly inferior figures if not for the enterprise division which did better. Verizon’s retail postpaid net adds on the consumer side were up by only 23K connections, though the carrier lost 189K consumer postpaid phone connections on top of the 215K consumer postpaid phone customers lost in the previous quarter. As noted, much of this downfall was offset by the enterprise division, which grew by 360K postpaid connections, 197K of which were phone activations. Verizon’s retail postpaid churn rate rose to 0.88% from 0.75% last quarter and from only 0.67% in the year-ago quarter. But it wasn’t all gloomy news for Verizon; the carrier saw its prepaid base grow (though only marginally by 39K connections) for the first time since the Tracfone acquisition a year ago. Also of note was the carrier’s successful in bringing in another 234K new customers (on top of the 168K FWA connections added in the previous quarter) for its 5G Home Internet service.

The NPD Take:

- AT&T delivered another impressive quarterly performance with 708K new postpaid phone subscribers, but it is important to highlight that, as in the previous quarters, close to half of these were FirstNet (emergency first responders) customers, whose revenue contributions will be marginal compared to average retail postpaid customers. Nevertheless, AT&T’s retail postpaid phone revenue reached the pre-pandemic levels of $55+ thanks to the carrier’s ability in signing up customers on its high-tier rate plans in return for higher trade-in credits on smartphone upgrades.

- Verizon’s continued loss of close to 200K postpaid consumer postpaid phone lines is alarming, but the carrier’s new affordable rate plans coupled with aggressive subsidies beating the competition (e.g., Verizon is the only postpaid carrier to offer the new Pixel 7 Pro for free after savings) should help bring new connections to offset the ongoing losses. We should also note that Verizon has been steadily losing postpaid phone subscribers to Comcast’s and Charter’s cable MVNO services but recuperates a portion of these losses in the form of wholesale revenues.