The Galaxy S wait will soon be over

This is the time of year for Galaxy S fans to get as excited as it is when Samsung teases the community with details of its upcoming flagship smartphone. Only a week after announcing the official launch date (February 1), Samsung’s head of mobile TM Roh addressed the community with an official blog explaining that the new flagship series will be all about camera, performance, and sustainability. The launch lineup will be similar to previous years, with the regular S23 being accompanied by the slightly superior S23+ and the true flagship S23 “Ultra” version.

The NPD Take:

- TM Roh’s teaser message is an easy one to decipher as imaging capabilities and device (chip) performance have been the centerpiece marketing features of the last decade. It is no secret that the new S23 will be powered by Qualcomm’s new generation Snapdragon 8 Gen 2, and it will boast the industry’s best-in-class optics.

- Performance and camera are touted as the top drivers influencing consumers’ purchase decisions of smartphones and adding sustainability to the mix rounds it all up from a marketing standpoint. According to the NPD Connected Intelligence Mobile Connectivity survey, 42% of smartphone owners cite that it is very or extremely important that their smartphone is sustainable and that it does not harm the environment.

- Samsung’s pre-debut of the S23 varies slightly from last year’s S22 pre-debut as, at the time, fans were offered an additional incentive of $50 (to be used towards accessories) for all pre-orders. This was a unique pre-order offer as customers were expected to commit to ordering the new phone without seeing the full spec details of the phone. Tis time around, Samsung opted not to offer the discount before releasing the details of the phone, but we expect to see aggressive bundle offers (for accessory add-ons or memory upgrades) similar to last year’s promos.

- The Galaxy S23 will be launching a time when US carriers have begun pulling back on subsidies and put more focus on BYOD promotions for cost savings. This new subsidy regime will require Samsung to pitch in extra as consumers have long been accustomed to receiving unrealistically high trade-in discounts when upgrading to a new smartphone.

Dish takes another hit

Dish Network last week provided select preliminary results of its mobile operations prior to the official release of its Q4 financials. The company’s Boost Mobile prepaid operation lost another 24K subscribers during the busy Q4 period. Dish ended the year with 7.98 million mobile subscribers, which also includes a small base of users running on the previously-acquired Ting Mobile and Republic Wireless. Notably, Dish had over nine million subscribers when it took over the Boost Mobile from Sprint in mid-2021. The company has been losing subscribers in every single quarter apart from Q3 2022 when its base grew by a thousand connections.

The NPD Take:

- Dish Network has acquired a highly elusive prepaid base from Sprint, and its lack of experience and focus has resulted in losses of over a million subscribers in six quarters. It is, however, important to note that Boost is not the only carrier feeling the heat: the prepaid sector has long been struggling to grow due to the migration of higher end users over to postpaid services. While Dish lost 24K subscribers, this is still an improvement considering that the Q4 2021 were tenfold (245K).

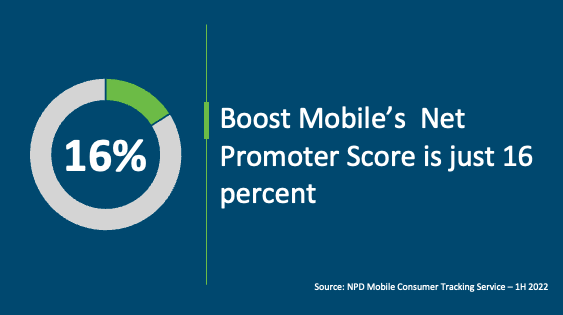

- Dish Network is tasked with reaching a 70% POP infrastructure coverage by June 2023 and has been putting all its focus on meeting this network buildout deadline, while formulating a postpaid service (Boost Infinite) that would run on this new 5G network. As Dish (rightfully) allocated its limited resources to this network/postpaid service build out, the Boost Mobile prepaid operation had little to work with in an extremely competitive prepaid market driven by the three big carriers with deep pockets. Boost Mobile typically fails to match competition in device selection and subsidies and has the lowest Net Promoter Score (NPS) among all tracked carriers in NPD’s Mobile Consumer Tracking database.