Carrier Q4 2022 financials are in

With T-Mobile releasing the results of its Q4 2022 operations last week, the carrier earnings circle for 2022 is completed. We have spotted several important trends worth highlighting such as the continued contraction of the prepaid segment in favor of the growing postpaid accounts, the cable MVNOs’ unstoppable march in attracting new customers away from the wireless carriers, and the decline in device upgrade rates, which put tremendous pressure on handset makers. Here is a quick summary of the top three carrier and the Cable MVNOs’ Q4 2022 results:

AT&T

AT&T announced another a strong quarterly performance with 1.1 million new postpaid net adds, 656K of which were postpaid phone connections. This brings the annual total to 2.9 million new postpaid phone customers for AT&T. In contrary, the carrier – for the first time in ten years – saw its prepaid phone base contract (by 13K prepaid connections) on a quarterly basis. Postpaid churn, on the other hand, improved slightly from 0.85% in Q4 2021 to 0.84% at the end of Q4 2022. AT&T’s postpaid upgrade rate declined from 5.3% in the year-ago-quarter to 4.8% in Q4 2022.

The NPD Take:

AT&T had another stellar quarter, but it is important to point that the postpaid phone net adds were below the previous quarter (708K) and the year-ago-quarter’s (884K) postpaid phone net add performances. This is primarily due to the carrier pulling back on its aggressive device subsidies. AT&T CEO Stankey indeed signaled a less-aggressive subsidy regime due to the excessive cost of financing these promotions. While AT&T’s declining device upgrade rates are partially driven by Apple’s inventory challenges with the popular iPhone 14 Pro models, the lack of attractive deals have fostered (and will foster) many users hold on to their phones for longer periods.

T-Mobile

The Un-carrier once again announced an industry leading performance with 927K new postpaid phone subscribers. Notably, this was the highest figure recorded since the last quarter of 2019 when the carrier passed the million mark. T-Mobile’s total postpaid base grew by a whopping 6.4 million connections in 2022. T-Mobile announced an all-time low Q4 postpaid churn of 0.92%. T-Mobile sold 8.3 million phones during the quarter, which was significantly down from 11.6 million units sold in the year-ago quarter (hence the drop in the upgrade rates from 5.8% to 3.9% YoY). Incidentally, T-Mobile announced that its prepaid base increased by 25K new connections, though it also announced the addition of 74K new prepaid Fixed Wireless Access (FWA) internet customer, meaning the Un-carrier’s prepaid phone base shrank by 49K phone customers. Notably, the carrier also added 450K new postpaid FWA customers, thus bringing its total FWA base to over 2.6 million by the end of the year (2 million total FWA additions in 2022).

The NPD Take:

Reaching almost a million new postpaid phone connections at a time when device upgrades (smartphone sales) decline highlights T-Mobile’s successful BYOD strategy, coupled by its strong free line promotions. We believe that T-Mobile would have seen a higher upgrade rate if it had succeeded in securing more inventory from Apple during the year’s heaviest season of iPhone sales. Also, while the decline in the prepaid phone segment is alarming, T-Mobile was able to migrate 650K Metro prepaid customers over to the postpaid Magenta side (175K of which were added this quarter).

Verizon

The nation’s largest service provider, Verizon, had another underperforming quarter compared to rivals AT&T and T-Mobile, though Verizon announced 217K new postpaid phone subscribers, 41K of which were added by the Consumer Segment. This note is important as it was the only quarter in 2022 when Verizon announced positive postpaid phone net adds (the carrier lost 696K postpaid phone subscribers in the first three quarters of the year). Verizon’s retail postpaid phone churn rate rose to 0.86% from 0.77% in the year-ago quarter. Notably, while the carrier’s postpaid upgrade rate went down from 5.7% in Q4 2021 to 5.1% in Q4 2022, this was still higher than rivals AT&T and T-Mobile. The postpaid consumer division’s comeback performance, however, was slightly offset by the losses on the prepaid front as the carrier’s prepaid base declined by another 175K connection on top of the 355K connections lost since the takeover of Tracfone in Q4 2021. Incidentally, Verizon was also able to sign another 379K new customers (on top of the 234 FWA connections added in the previous quarter) for its 5G Home Internet service.

The NPD Take:

Verizon’s leading performance in device upgrades is likely due to its ability in securing additional iPhone 14 stock in December when rival carriers and channels were out of stock. This upgrade rate will likely go down notably in Q1 and onwards as Verizon’s new service offers, like the $100/4-Lines Unlimited plan, are BYOD-focused. While these offers should attract new customers, we do not expect the carrier to complement these offers with additional device subsidies as the carrier has outlined that the objective will be retaining its lucrative subscriber base versus growing the base by spending.

Cable MVNOs

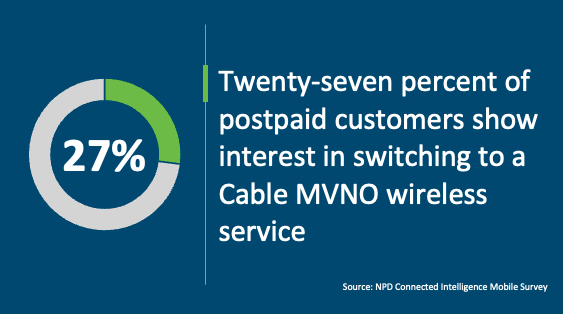

Cable MVNOs Comcast and Charter continued to ride the momentum they have been enjoying for the past several years with a cumulative record 980K new mobile subscribers on top of the 729K mobile subscribers added in the previous quarter. Charter’s Spectrum Mobile, which had previously hit the four million subscribers mark in Q2 2022, added a record 615K new mobile lines during the quarter and passed the 5 million mark (5.29 million to be exact). Spectrum Mobile’s annual net adds in 2022 (1.73 million) were noticeably higher than the cumulative adds of 1.19 million in 2021. Spectrum Mobile’s quarterly revenues increased by 38% YoY, though so did its expenses (up 36% YoY). Comcast, on the other hand, ended the quarter with 5.3 million mobile subscribers, 365K of which were added in Q4 2022.

The NPD Take:

The Cable MVNOs’ direct marketing and aggressive pricing was able to churn over ten million subscribers away from the nationwide network operators. Spectrum’s record-breaking growth is Q4 2022 is due to its new mobile/cable campaign offered at $49/month for the first year of service. This is a tricky business strategy as cable company have a reputation to displease customers with substantial rate hikes after the introductory offers expire. Spectrum might run into a comparable situation when the new plan pricing rolls in, though its upcoming CBRS-based small-cell network deployment can help fund the continuation of these aggressive price offers as it will be able to reduce its wholesale costs (paid to Verizon) in the long run.