May the Fold be with you

Google has long been expected to add a foldable model to its Pixel lineup, which continues to gradually grow its user base in parallel to its heavy marketing campaign. The wait has end as Google officially ¨leaked¨ a video of the upcoming Pixel Fold (on May 4 with a Star-Wars catch phrase), and an official unveiling at the upcoming Google IO event this week. There is no official information on the phone´s technical specifications but rumors suggest that it will boast a 7.69-inch main fold display and a 5.79-inch outer display. The teaser video suggests a rear camera bump, similar to Pixel´s heritage camera bump featured on the existing models, and according to the rumors the main camera will have 50-megapixel lens. There is also no word on the Pixel Fold´s suggested debut price, but expectations put it somewhere between $1500 and $1800.

The Circana Take:

- Google´s foray into foldables is important for the growth of the segment in the US as options have been extremely limited for consumers. Unlike in global regions where consumers have multiple brands (e.g., Honor or Oppo) and foldable device series to choose from, U.S. consumers have been limited to Samsung’s top-notch but expensive Galaxy Fold series.

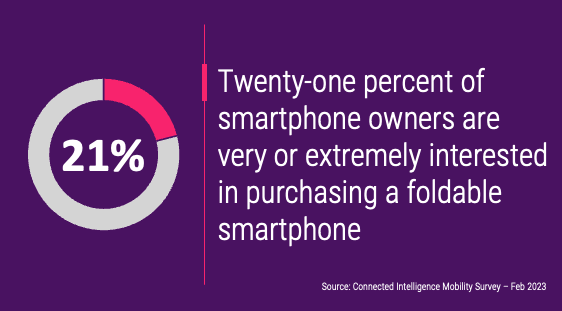

- While consumers show high interest in foldables smartphones (according to the latest Circana Mobile Connectivity survey, 21% of smartphone owners are either very or extremely interested purchasing a foldable smartphone), Apple’s commanding market share, especially among the high-income segment who can afford foldables, is a major barrier in adoption. Nevertheless, of the few iOS churners who switched to the Android platform for their latest smartphone, 10% of them did so for the foldable form factor offered by Samsung.

- Google’s to-be-announced pricing on the new Pixel Fold will be critical; we would expect new Pixel Fold to undercut Samsung’s $1800 pricing on the Galaxy Fold in order to have a chance at gaining meaningful market share. However, the real catalyst deciding the Pixel Fold’s fate will be how generous U.S. carrier and Google will be on the subsidies. U.S. carriers are clearly pulling back on subsidies, and this might force Google to pitch in more subsidies than it has planned in the first place.

- Rival Samsung has its fourth foldable iteration out on the market, yet mainstream consumers are still struggling to justify the cost of this model due to durability concerns. We expect to hear more about what Google has in the bag to give consumers the peace of mind they need for their investment. It would not be surprising to see Google adding the new Fold to its Pixel Pass subscription program, which offers early upgrades, additional Google service bundles (e.g., YouTube Premium and YouTube Music) as well as warranty repairs.

All carrier Q1 financials are in

With Dish Network releasing the results of its Q1 operations yesterday, we now have the complete picture of the landscape of wireless connections for early 2023. Here is Circana’s quick take on the major trends coming out of the financials:

- Unstoppable cable MVNOs: The cable MVNO’s continue to impress and Q1 2023 was a memorable quarter, especially for Charter, which was able to attract almost 700K new mobile lines (almost double that of Comcast’s 355K net adds during the quarter). Charter’s aggressive Spectrum One bundle that offers home cable Internet and unlimited data on a mobile line for $49/month is the main driver of this growth. However, as we have been commenting since the debut of this plan, the $49/month pricing is good for only a year, and Charter (and Comcast, which later followed suite to launch its bundle plan) is poised to deal with uneasy user base who no doubt recall when their cable bill skyrocketed at the end of their promotional cycle. Price increases next year is a must for both cable MVNOs in order to be profitable, and it is still not clear as to when they can enjoy their owner economics financial benefits to be derived from the debut of their CBRS-based networks in dense urban areas.

- Headwinds continue for device makers: Another trend we have been highlighting for a long time has been carriers’ reluctance to push aggressively with device subsidies due to excessive cost of financing during the high interest rate era. This trend was clear in every carrier’s financials with device revenue and costs decreasing in parallel with the decline seen in postpaid handset upgrades. With carriers increasing their focus on BYOD at a time when consumers are looking into postponing their device replacements/upgrades due to the economic uncertainties out there, smartphone makers should prepare for a rocky ride for the remainder of the year.

- User base is not the only shrinking part of prepaid: The migration from prepaid to postpaid accounts is another topic we have been discussing for the last several years, and the shrinking connections (mainly at Verizon’s prepaid base) is a clear indication that the migration has yet to stop. T-Mobile was once again able to migrate close to 150K of its prepaid customers over to the postpaid side, but as the prepaid market loses the lucrative customer base to postpaid, collateral damage takes place in terms of service revenues. In Q1 2023, ARPU on prepaid accounts declined across the board at every tracked carrier.

- Boost Mobile subscribers are still up for grabs: Dish Network yesterday announced that they lost another 81K Boost Mobile customers on top of the 900K customers lost since the takeover from Sprint. The company is tasked with blanketing 70% of the nation with its 5G network by the end of June, while trying to start a postpaid business from ground zero. The spiraling down of Boost Mobile is likely due to this in business focus that even resulted in multiple days of service failures due to systems shutdowns in Q1.