The era of spatial computing

Apple unwrapped its much-anticipated mixed reality headset, the Vision Pro+, last week, potentially ushering in the era of spatial computing. There has been extensive press coverage of the new device, its capabilities and (expensive!) price tag, but not a lot of coverage on how this new spatial computing device will impact the mobile sector in the long run.

The Circana Take:

- There is no question that the Vision Pro+ is expensive and at the same time we have no doubt that Apple will have difficulty keeping up with the demand (likely due to a controlled supply strategy) even at this price point. We are not going to get into the pricing debate, but rather consider that this is an initial statement of capabilities that is not targeting the mass market. All players in the mobile ecosystem need to think about 3-4 years down the road when Apple launches a more capable, slimmer, cheaper version of the Vision Pro+ and work on their future game plans accordingly.

- When the price of the Vision Pro+ comes down (maybe it will not be called the “+” at that point) to the sub-$2000 levels, a larger portion of iPhone flagship buyers will likely consider purchasing it. At that point, the use case may evolve to one beyond the home, that could include a cellular version. As a result, carriers need to start planning for how they will be part of the distribution game, and that translates into additional financial burden in terms of inventory and management costs.

- Circana estimates that close to two thirds of the U.S. postpaid customers use an Apple iPhone, and when the affordable generations of the Vision Pro+ become available, these customers will be at a crossroad as only a small portion of them will be able to afford the headset and a flagship iPhone. As the adoption of the headset gradually grows, we would expect mainstream users either downgrade to more affordable iPhones or prolong their upgrade cycles (hence suppressed iPhone volumes/revenues in the long run).

- Carriers will no doubt be hopeful that the Vision Pro+ will emerge as a strong use case for 5G connectivity in a few years’ time. But that somewhat misses the point: 5G does not really need a “use case” as the consumers are all migrating to this network anyway (whether they “need” the benefits or not) as all new smartphones are 5G-based. Will the Pro+ create a need for an additional line of service and even faster, lower latency connections? Perhaps…

Prime Mobile: Carriers’ nightmare scenario

A Bloomberg article citing anonymous sources sent shockwaves to the wireless sector as it claimed that Amazon is in talks with multiple network operators including Dish Network for wholesale service agreements for a possible mobile service offering geared for Prime customers. The article suggested monthly service fees of as low as $10, or even the possibility of a free service option for certain customer tiers. All major operators saw their stock prices tumble following the article. AT&T, T-Mobile, and Verizon all publicly confirmed that they are not in talks with Amazon for a wholesale service partnership; Amazon also publicly commented that they are constantly looking ways of adding more benefits for Prime members, but don’t have plans to add wireless at this time.

The Circana Take:

- It’s a strategy that we have long expected from Amazon as it looks to add more value to Prime while also getting closer to the consumer’s connectivity. And it’s not the company’s first attempt either: Amazon offered cellular connectivity through its older generation Kindle e-readers as well as a handful of Fire tablets. And then there was the infamous Fire Phone, which was a major flop due to network exclusivity (with AT&T) and various other hardware/software related reasons. Amazon’s efforts in becoming an ecosystem player for home connectivity through Eero, Ring or Sidewalk product lines have merit, but offering a mobile phone service is a different kind of beast, especially in a market where only a few standalone MVNOs are left due to consolidation.

- Selection of Dish as the network partner would be a risky proposition considering that Dish’s new Open RAN 5G network has yet to prove itself as a reliable and scalable network with extensive coverage. Amazon might be inspired by cable MVNOs’ successful run in the last several years, but that growth was achieved by an effective bundling (internet and wireless) solution that runs on the nation’s most reliable network, as well as the cable companies having essentially blanketed their markets with WiFi. As a result, neither Comcast nor Charter had to worry about customer complaints due to the coverage or speed.

- Amazon could join forces with one of the three network operators, but it is unlikely that it would get favorable wholesale terms as carriers may not want to help Amazon start a new race-to-the-bottom pricing war.

- Boost Infinite, Dish Network’s new postpaid offering, is inferior to all competitors when it comes to distribution. A partnership with Amazon where the e-tailer giant becomes a central distribution hub for the service would be beneficial for both companies as Amazon can enjoy low-cost access to the Boost Infinite’s upcoming 5G network (if/when the network checks the box for reliability and coverage) for future product/service deployments.

The Razr is back (again)

Motorola recently announced the upcoming availability of its updated Razr flip smartphone. The new Razr+ is a high-end foldable (flip form factor) smartphone running on Qualcomm’s Snapdragon 8 Gen 1 chipset and boasting a 6.9-inch foldable display. The new phone has a full function 3.6-inch outer clam display, which is a major improvement on the predecessor’s 1.6-inch outer display, which did only slightly more than showing notifications. The new Razr+ will be available for pre-orders as unlocked through Motorola and Best Buy and locked through AT&T and T-Mobile (which will offer an exclusive Magenta color version as well) beginning June 16. The phone will sell for $1,000. Motorola also showcased an entry-level version of the phone, the Razr, which has a small 1.6-inch outer display and a downgraded Snapdragon silicon from Qualcomm. Pricing and availability of the budget Razr will be available later this year.

The Circana Take:

- Motorola had an unfortunate launch with the initial Razr due to the timing that coincided with the start of the COVID-19. The OEM had a major supply issue at a time when demand was also scarce for premium products due to economic uncertainties. The company later launched a 5G-powered version in late 2020, but that version also failed due to the pandemic.

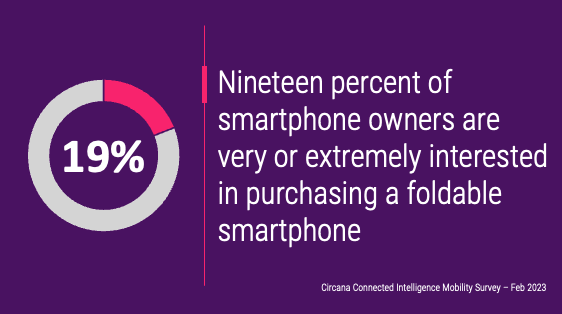

- While the debut timing of the Razr+ was not as ideal as Apple’s new mixed reality headset captured all the spotlight, the phone’s improved specs and pricing ($1,000 vs a $1,400 price tag on the predecessor) should help reach a larger audience compared to its predecessor. Nevertheless, the foldable category is still a small niche, and the flip version is even smaller as it primarily caters to female users.

- Like its predecessor, the new Razr+ will not be available through Verizon, Motorola’s original distribution partner for the initial razr. This is likely because the phone does not support Verizon’s mmWave 5G technology, which requires additional antennas (which do not fit in the Razr+’s ultra-slim form factor).

Boost Infinite: iPhone on us

Dish Network is tasked with reaching a 70% POP coverage by June 2023 and has been putting all its focus on meeting this network buildout deadline, while formulating a postpaid service, Boost Infinite, that runs on this new 5G network. While the service is being tested in several beta markets, Dish has begun offering an MVNO-based service (powered by wholesale partnerships with AT&T and T-Mobile) and added the iPhone 14 to the mix. Boost Infinite is now offering customers who sign up for its new $50/month Unlimited Plus plan a free iPhone 14 though with trade-in.

The Circana Take:

- Boost Infinite’s free iPhone 14 offer is appealing but it negates the carrier’s motto of bringing price balance to the competition with its $25/month unlimited plan offer launched at the time of the debut of the beta service. Considering the lack of content perks, the $50/month service price is not competitive despite the free iPhone offer (which also requires trade-in).

- The Unlimited Plus plan runs primarily on Dish’s wholesale network partners as the iPhone 14 is not provisioned to run on Dish’s own 5G network yet. This MVNO-centric plan has forced Dish to throttle the Unlimited Plus customers when they reach 30 GB of data usage. Dish’s Boost Mobile prepaid brand ranks at the bottom of Circana’s carrier Net Promoter Score (NPS) rankings, and service offerings inferior to postpaid rivals’ services will steer the Boost Infinite brand in the same direction.