AT&T and Verizon end the year strong

AT&T and Verizon announced the full results of their financial and operational performances for the final quarter of the year. Verizon was the first to take the stage to announce 558K new postpaid phone subscribers (222K of which were enterprise accounts), exactly double the amount (279K) recorded in the final quarter of 2020. Incidentally, this was the first quarter when Verizon released the figures for its new prepaid base including the recently acquired Tracfone operation. Verizon announced that it had 23.9 million prepaid users, down 85K from the previous quarter (combining the previous Verizon and Tracfone standalone bases). The carrier’s retail postpaid churn (0.94%) in the consumer business improved slightly from last year (0.96%), while the retail postpaid phone churn increased slightly from 0.76% to 0.77%. Rival AT&T, on the other hand, had another massive quarter with an industry-leading 884K new postpaid phone additions on top of the 928K new postpaid phone subs added in the previous quarter. The carrier also added 24K new prepaid subscribers during the quarter; although this was a major improvement from the year-ago quarter’s 40K prepaid subscriber losses, it was a quite low figure compared to an average 210K new subscribers added in each quarter in 2021. Incidentally, AT&T’s postpaid phone churn was recorded as 0.85%, which is the highest level seen in the past six quarters.

The NPD Take:

- AT&T’s extension of its new line device subsidies to its existing user base has helped the carrier retain its base, but the secret sauce to its impressive postpaid phone base growth has been the magnitude of the subsidy offers as well as extending payment plans to 36 months. This aggressive promotional tactic puts pressure on AT&T’s EBITDA, and the carrier will likely pull back on the subsidies and gets its device promotions more on par with rivals’ offerings.

- The contraction of Verizon’s prepaid segment during the initial quarter of Tracfone’s integration was fueled by device supply constraints as well as the ongoing migration from prepaid to postpaid accounts. According to NPD, almost half of prepaid switchers migrated to postpaid accounts in the second half of the year, but this migration might slow down in parallel to the anticipated economical downturn later in the year.

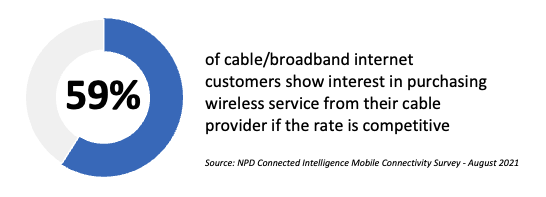

Cable MVNOs keep the pressure on network operators

Comcast and Charter last week announced the results of their Q4 2021 operations. Both cable MVNOs continued to ride the momentum they have been enjoying for the past several years with a cumulative record 692K new mobile subscribers (compared to 568K in Q4 2020 and 603K in Q4 2019). Charter’s Spectrum Mobile, which had previously hit the 3 million subscribers mark in Q3 2021, added a record 380K new mobile lines during the quarter. Spectrum Mobile ended the year with 3.6 million mobile customers, 1.2 million of which were added in 2021. Spectrum Mobile’s quarterly revenues increased by 59% YoY, while the annual revenue growth was 47%. Comcast, on the other hand, ended the year with 4 million mobile subscribers, 312K of which were added in the final quarter of the year. Comcast’s Q4 mobile revenues grew by 40% with annual profits from its mobile operations reaching $152 million.

The NPD Take:

- Spectrum Mobile’s record subscriber additions were expected, as the cable MVNO dropped its family unlimited plan pricing per line to $29.95 earlier in October. Spectrum’s aggressive pricing will likely impact its profitability considering the growing cellular data consumption levels as Wi-Fi offloading will decline when the pandemic conditions clear.

- The two cable operators have managed to steal 7.5 million customers away from mobile operators and they are poised to become an even greater threat once the deployment of their CBRS-based network buildouts begins in dense urban areas.