Carrier Q3 2023 financials are in

With Dish Network releasing its Q3 results last week, we now have the complete picture of the landscape of wireless connections as we head into the busy holiday shopping season. Here is Circana’s quick take on the major trends coming out of the financials and what to expect for the reminder of the year:

-

AT&T and T-Mobile keep shining: AT&T maintained its strong momentum with the addition of 550K new postpaid connections, 468K of which are new phone lines. AT&T also saw a notable revenue growth (ARPU up 0.6%) thanks to additional roaming revenues and the success in migrating users to upper tier rate plans. The latter push was achieved partially by its successful new iPhone 15 campaign, which the carrier said had brought in record number of pre-orders in late September. The carrier also enjoyed a drop in both postpaid and prepaid churn while growing its prepaid base slightly (by 28K new subscribers). T-Mobile, on the other hand, once again led the industry with another 850K new postpaid phone subscribers added in Q3 2023. The carrier had a record low Q3 postpaid churn of 0.87%, while also improving the Q3 prepaid churn at 2.81%. The carrier added 79K new prepaid connections, though 55K of them were high-speed internet (FWA) subscriptions.

-

Postpaid bleeding slows down at Verizon: Verizon has steadily lost consumer postpaid phone subscribers in every quarter in the past two years, with the exception of Q4 2022. While Q3 2023 was no exception, the carrier lost only 51K consumer postpaid phone connections versus 189K connections in the year ago quarter. Verizon’s enterprise arm, on the other hand, again pitched in with over 150K new postpaid phone connections to offset the losses on the consumer front. We attribute Verizon’s improved performance to its streamlined rate plans allowing easy configuration at affordable prices as well as the highly aggressive trade-in promotions run on the latest iPhone 15 series (Verizon is the only carrier allowing customers to trade-in aged models with hardware defects such as cracked screens and receive full rebate). The carrier’s prepaid business, however, continued to be an area of concern.

-

No stopping in prepaid-to-postpaid migration: While both AT&T and T-Mobile announced slight gains in prepaid phone subscribers, the prepaid market continues to shrink as many prepaid customers continue to churn over to postpaid side. Verizon (primarily its Tracfone arm) lost another 207K subscribers in Q3 2023 on top of the 1.3 million prepaid subscribers it lost since the beginning of 2022. As shown in Circana’s bi-annual surveys, we see more and more prepaid subscribers seeking postpaid options to save on their monthly bills as lower end postpaid plans, especially those that feature video app bundles, are as affordable as unlimited prepaid plan prices.

-

The nightmare continues for Dish Network: Dish Network last week announced the loss of another 225K Boost Mobile customers on top of the one million connections it has lost since the takeover from Sprint. Dish shifted focus to network build-out in order to reach the 70% nationwide coverage enforced by the FCC, and this focus shift has cost the company dearly. Dish’s digital distribution deal with Amazon and the aggressive iPhone bundle offers built for its new Boost Infinite postpaid service were not enough to win new business and offset the losses. Boost Mobile customers will continue to be an easy target for all prepaid brands trying to win new customers during the holiday season and onwards.

-

Cable MVNOs charge relentlessly: We have long been praising the cable MVNO business model that drew over 13 million postpaid phone subscribers with attractive bundle deals. Charter deserves a special mention as it’s been consistently adding an average of 600K of new subscribers for the last year, and Q3 2023 was no different. Comcast also maintained its steady but more humble momentum at around 300K subscribers added during the same quarter. The cable MVNOs’ aggressive $49/month home internet-mobile bundle will continue to attract customers especially during the high inflationary environment when many consumers are actively seeking ways of cutting back on their spending, but it should be noted that these offers expire after a year (at Charter) or two (at Comcast), thus both companies may see elevated churn levels in the coming quarters.

-

Mobile carriers push back with FWA: Losing over 13 million lines over to cable MVNOs has not been easy to digest, but mobile carriers have found the remedy to get back at the cable companies. T-Mobile and Verizon’s 5G-based FWA Home Internet service client base has collectively reached 6.9 million customers (T-Mobile added over half a million new connections in Q3) and AT&T came in to round it to 7 million with its newly released Air Internet FWA service in Q3 2023. Circana’s latest mobile survey data revealed that customer demand for FWA continues to be high and we expect all three carriers to gradually grow their FWA bases in the coming quarters as they allocate more bandwidth for this service.

-

Device makers still cannot move inventory: Another trend we have been highlighting for a long time is the steadily declining postpaid upgrade rates that help carriers reduce their equipment costs. All three major postpaid players saw their upgrade rates drop notably from the year ago levels (T-Mobile taking the lead with a YoY drop from 3.8% to 2.7% in Q3 2023), hence the record level declines we have seen in new smartphone sales during the quarter.

-

Who picks up the last standing operator? USCellular, which recently revealed that it is evaluating new strategic options including a possible takeover by another operator, lost another 38K postpaid subscribers in Q3 2023 as its base gets closer to dropping below the 4 million mark. The company will likely want to accelerate the potential sales to one of the major three operators or even cable MVNOs, but it should be remembered that any bidder would have to de-invest significant parts of the assets such as the network towers or aged equipment that may not be compatible with their existing network structure.

-

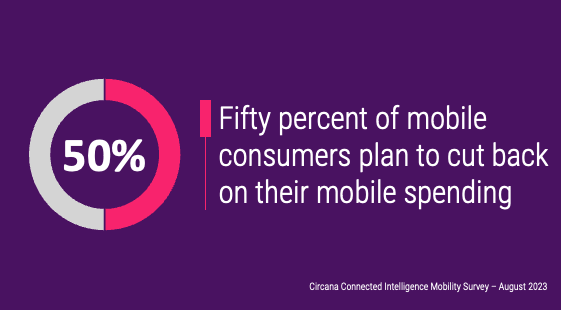

What is the bag for the holiday season? Circana’s latest Connected Intelligence Mobility survey revealed that half of mobile consumers are seeking ways of cutting back on their mobile spending, and many of them will do so by postponing their new phone purchases. On the other hand, new promotional offers such as T-Mobile’s recent four free iPhone 14 on four lines for $100/month will certainly motivate those price-sensitive customers waiting on the sidelines for an upgrade. We should also note that Circana’s new Holiday Shopping survey shows that consumer appetite to buy a new smartphone, especially an Android-powered one, is lower than in the previous year, thus newly released models like the Google Pixel 8 series may experience challenges to sell in volume.

On the services front, we expect Verizon to end the year on a positive note (especially on the consumer postpaid phone front), but the prepaid side of the business will continue to deal with the challenges faced by the entire prepaid industry.