The big three end the year strong

The nation’s top three wireless service operators all released the results of their busy Q4 operations last week. Here is Circana’s quick take on the major trends from the financials:

Verizon stops the postpaid consumer bleeding:

Verizon’s enterprise division has been a savior of its postpaid business for a while as the carrier had been losing consumer postpaid phone lines to rivals, including its wholesale clients, the cable MVNOs. However, as we noted during our market update presentations, Verizon clients have recently demonstrated a lower propensity to churn to other providers because of its new “value” marketing strategy based on simplified and affordable a la carte service options, combined with aggressive device subsidies. As a result, Verizon attracted 318K new consumer postpaid phone lines in Q4, up from 41K in the year-ago-quarter, and versus an aggregate loss of 450K lines during the first three quarters of the year. The enterprise segment also grew by 292K new phone lines, though this was the lowest figure recorded across all quarters in 2023 and was about 35% below the carrier’s Q4 2022 performance.

The unstoppable Un-carrier:

T-Mobile once again led the industry with the addition of almost a million new postpaid phone lines (934K) in Q4 2023. With this record quarterly performance, T-Mobile’s yearly postpaid phone net adds totaled 3.08 million new lines (perfectly in line with last year's 3.09 million figure). Notably 610K of these new lines were ex-prepaid customers on T-Mobile’s prepaid brands, such as Metro, but this does not necessarily mean that the carrier was able to attract almost 2.5 million new customers from rivals. Rather, T-Mobile executives publicly referred to enterprise users activating additional lines on the same device as a driver behind this growth though we believe that there are other factors, such as T-Mobile recent BOGO line or free line promotions. Notably, the carrier also announced a slight increase in postpaid phone churn of 0.96% (up from 0.92% in the year-ago-quarter).

AT&T growth slowing?

AT&T added 1.74 million new postpaid phone lines in 2023, 526K of which were added in the last quarter. While this figure higher than that of Verizon, AT&T’s Q4 postpaid phone net add performance was 40% and 20% lower than its Q4 performances back in 2021 and 2022, respectively. We attribute this decline in growth to Verizon’s robust performance in stopping churn as we had seen many Verizon customers move to AT&T in the last several years. Notably, Circana’s latest Connected Intelligence Mobility survey reported a higher than average switching propensity rate for AT&T customers, and the carrier saw its postpaid churn inch up slightly in Q4 2023.

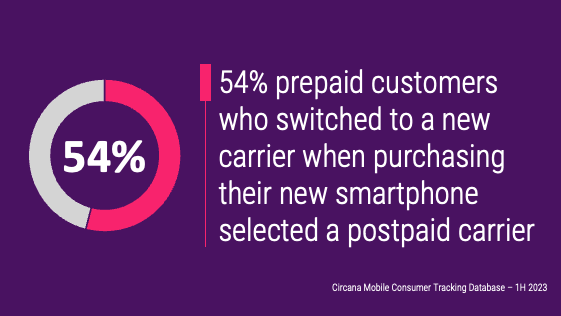

Prepaid continues to shrink:

We have long been reporting on the trend of good-credit prepaid customers migrating over to postpaid accounts, and that trend continues. Verizon, which lost over 860K prepaid subscribers during the first three quarters of the year, saw another loss of 289K prepaid clients in Q4 2023. AT&T, which had been slowly growing its prepaid base, lost 135K prepaid users in Q4 2023. T-Mobile, on the other hand, brought in 53K net prepaid adds, but the carrier announced that another 170K ex-prepaid customers (Metro) migrated to the postpaid magenta side, on top of the 440K ex-prepaid customers who dropped the T-Mobile prepaid service in favor of the carrier’s postpaid offerings. Most of these migrating users claim that they primarily adopted postpaid due to the aggressive entry-level pricing offered on the postpaid side. Considering the gradually increasing postpaid service prices, we will see a slowdown of this pre-to-post migration in the coming quarters.

Consumers still hesitate to upgrade to new smartphones:

Another trend we have been highlighting for a long time is the continuously declining postpaid device upgrade rates with many consumers postponing their device upgrades. Despite the debut of Apple’s latest iPhone 15 series, every carrier announced declines in postpaid upgrade rates (T-Mobile down from 3.9% in Q4 2022 to 3.2% in Q4 2023; AT&T down from 4.8% in Q4 2022 to 4.7% in Q4 2023; Verizon down from 5.6% in Q4 2022 to 4.4% in Q4 2023). As we commented in our previous market update sessions, Circana expects to see a reversal of this trend in 2024 as battery performance problems will foster many consumers seeking device upgrades.

Rising star FWA:

T-Mobile and Verizon’s 5G-based FWA Home Internet service client base has collectively reached 7.8 million customers in Q4 2023. T-Mobile saw over half a million new connections (541K), which was in line with last year’s performance (524K). Likewise, Verizon added another 375K new consumer and enterprise customers for its FWA service. AT&T, which joined the game late (in Q3 2023) with its Air Internet FWA service, added another 67K new subscribers on top of the 26K subscribers added last quarter. AT&T will not be able to catch up to its rivals any time soon as its FWA footprint is limited. Incidentally, the FWA momentum may slightly slow down in the coming quarters as carriers (especially T-Mobile) have recently increased their monthly fees for the service.