Verizon goes for a 36-Month EIP

Verizon recently modified its Equipment Installment Program (EIP), which now offers customers 36-month interest-free financing for mobile phone, smartwatch, and tablet purchases. The carrier’s previous program offered customers the ability to pay in either 24 or 30 monthly installments for their device choice. Verizon follows the footsteps of rival AT&T, which previously replaced its 30-Month EIP with a 36-Month program back in June 2021. The other main rival, T-Mobile, has long set its EIP program to 24 months, though it has been extending the payment terms to 30 months (all iPhone 12 and 13 models were sold with a 30-Month payment option until January) or 36 months for expensive superphones such as the Samsung Galaxy Fold 3, which carries an $1800 price tag.

The NPD Take:

- While the extension of the interest-free payment term from 30 to 36 months will adversely impact Verizon’s bottom line, this will be offset by the anticipated reduction in churn as most users do not begin shopping for a device upgrade until their current phone is fully paid off.

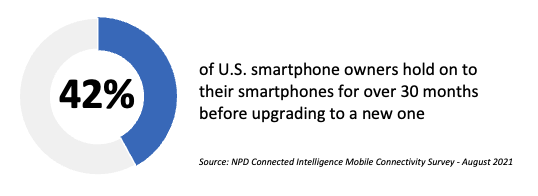

- With the industry predominantly steering towards the 36-month payment option, we should subsequently expect to see an extension in device upgrade cycles (thus lower sales volumes), which are already at all-time high levels with 42% of U.S. smartphone owners holding on to their smartphones for over 30 months before upgrading to a new one.

T-Mobile delivers another strong postpaid performance

The Un-carrier announced the results of its Q4 2021 operations, adding an industry-leading 1.75 million new postpaid subscribers, 844K of which were postpaid phone additions. T-Mobile’s postpaid net adds for the full year reached 5.5 million new connections, up 32% from 2020. The carrier’s prepaid business also grew, but only by a small margin (up by 49K new connections, the lowest figure recorded since Q1 2020) compared to the postpaid side. T-Mobile sold a record 11.6 million new phones in Q4 with a 5.8% upgrade rate, which was the highest level recorded in the past two years, but short of the 6%+ levels seen before the Sprint acquisition. T-Mobile’s postpaid churn, which had previously hit a record low of 0.8% in Q2 2020, has increased to a four-year high of 1.1% in Q4 2021. Similarly, prepaid churn passed the 3% mark for the first time since the beginning of 2020.

The NPD Take:

- T-Mobile’s strong postpaid performance was slightly short of AT&T’s 884K new postpaid phone additions but that was because the Un-Carrier was not as aggressive as AT&T in extending the switcher subsidies over to its existing user base.

- T-Mobile’s record sales of 11.8 million new phones show a sign of strong gross adds, but the increase in postpaid phone churn can be alarming if rival AT&T continues its aggressive promotional campaigns. T-Mobile will also need to closely monitor the cable MVNO threat, which systematically churns 2.5 million+ postpaid customers away from the major postpaid carriers every year.