Dish confirms Boost Mobile buyout

Last week, it looked as though Dish was getting cold feet regarding the purchase of Sprint’s Boost Mobile assets as part of deal T-Mobile/Sprint struck with DoJ. Dish Network was named as the buyer of Sprint’s Boost Mobile brand (and its subscribers) at an agreed sales price of $1.4 billion. The deal was expected to close by June 1 (although the DoJ deadline is July 1), and that there had been rumors about Dish trying to renegotiate the terms of the deal with T-Mobile. Both T-Mobile and Dish last week submitted filings with the SEC last week, thus officially confirming the big take over for July 1.

The NPD Take:

- Dish has a tough task at hand as the Boost Mobile brand/subscribers are not the only assets it is acquiring from T-Mobile. The company is also on the hook to purchase $3.6 billion worth of low-band spectrum from Sprint and it is legally enforced to build a new network that will cover at least 70% of the population in three years. Dish will be acquiring over 9 million price-sensitive Boost Mobile customers, who are not the prime demographics for the 5G network Dish has in its mind.

- The wildcards here are the classic prepaid user demographics (with high churn propensity) that Dish would be inheriting and Dish’s lack of experience in running a mobile service operation.

AT&T to close 250 retail outlets

AT&T last week announced it will be permanently closing down about 250 of the AT&T and Cricket retail outlets that have already been shut down as part of the pandemic measures. According to the Communications Workers of America, AT&T will also be laying off 3400 employees from various departments in the next coming weeks. Notably, AT&T previously announced a $6 billion cost-cutting initiative to streamline its business.

The NPD Take:

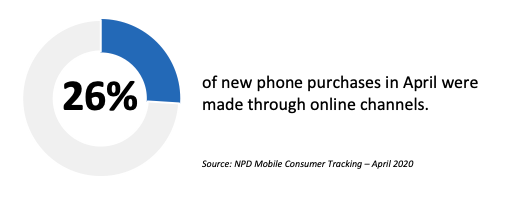

- Mobile phones are one of the very few tech products that have been resisting the e-commerce takeover given the assisted-sales requirements. The closure of retail outlets during the pandemic period, however, has resulted in a major surge in online phone purchases, whose share more than doubled from 12% in April 2019 to 26% in April 2020. We expect this shift in behavior to be permanent, thus rivals will likely follow AT&T’s footsteps in streamlining and optimizing their channel operations by the reduction of retail chains.

- 18% of U.S. phone users buy unlocked smartphones from non-carrier channels, and over half of these sales are coming from the online channels. Considering AT&T and Cricket’s leading positions in unlocked BYOD adoption, the reduction in retail outlets should not harm the overall business.

Qualcomm intros low-cost 690 Snapdragon 5G chipset

Qualcomm last week launched its first Snapdragon 600 series chipset that comes with built-in 5G support. The mid-tier chipset aims to provide OEMs with a cost-effective 5G solution though it will also support high-end features such as 120 MHz screen refresh rate as well as 8K-resolution support. Qualcomm announced that its OEM partners Nokia (HDM), Motorola, LG, Sharp, and TCL have already committed to building new 5G-smartphones based on the new 690 chipset later in the second half of the year.

The NPD Take:

- Qualcomm previously announced that it expects the global shipments of 5G-powered smartphones to be between 175 and 225 million units as of the end of 2020 despite the economic downturn. The introduction of the Snapdragon 690 will help Qualcomm reach its targets as it will allow OEMs to target the sub-$600 segments.