AT&T and Verizon announce somewhat upbeat Q2 earnings

Last week, AT&T and Verizon announced the financial results of their Q2 2020 operations. To no one’s surprise, the spotlight was on COVID-19 and its impact on the wireless carriers whose channel operations were halted during the lockdowns for most of the quarter. AT&T was the first to take the stage, and the carrier announced a decline of 151K postpaid phone customers, which includes 338K users counted as disconnects as they have been a part of the Keep America Connected pledge that offered payment concessions to economically challenged customers through the end of June 30, 2020. On an upbeat note, AT&T’s prepaid phone subscriber base was up by 165K. AT&T also announced a decline in churn; down from 0.86% in Q2 2019 to 0.84% in Q2 2020. Meanwhile, rival Verizon recorded a gain of 173K postpaid phone customers, 97K of which were consumer (non-enterprise) clients. The carrier also announced 12K net additions on the prepaid front. While that’s a modest figure, it should be noted that this is the first quarter in two and a half years Verizon has announced a positive figure in prepaid. Verizon, like rival AT&T, announced a drop in retail postpaid phone churn rate, from 0.72% in Q2 2019 to 0.51% in Q2 2020. On the other hand, Verizon’s total wireless service revenue declined 1.7% from Q2 2019; the decline was primarily driven by the 18% drop observed in consumer equipment revenue as a result of the store closures that limited device upgrades.

The NPD Take:

- The Q2 2020 panorama revealed by AT&T and Verizon are in line with the expectations we shared with our clients during our COVID-19 impact presentations. As part of the FCC driven Keep Americans Connected pledge, all major carriers offered their customers payment concessions, and this has helped to block a massive postpaid-to-prepaid exodus in Q2 2020. Nationwide store closures during the quarter were another factor adversely impacting this exodus and as a result, both carriers saw churn levels decrease in the second quarter of 2020.

- Verizon’s announced 18% decline in consumer device revenues is not surprising considering the low upgrade rates (due mainly to store closures as retail continues to account for the majority of device sales), but rival AT&T’s story was in stark contrast as the carrier saw its postpaid device activations drop from 4.1 million in Q2 2019 to 3.3 million in Q2 2020, yet its equipment revenues were up slightly. This increase despite a drop in device upgrades is a direct result of the increase in overall device ASPs at AT&T. NPD’s Mobile Consumer Tracking services revealed that the expensive iPhone 11 Pro and Pro Max were two of the top-selling three devices at AT&T during the quarter.

AT&T and T-Mobile to block non-VoLTE phones

AT&T last week began to reach out to its customers using certain phone models that do not support its VoLTE service (dubbed HDVoice at AT&T) and to let them know that their phone will no longer be operational after February 2022, the date when the carrier plans to shut down its legacy 3G network. AT&T’s message also encourages customers to purchase a phone directly from the carrier to ensure compatibility for the future. According to (alleged) internal documents revealed by a news site, rival T-Mobile, in a similar maneuver, is getting ready to turn off its legacy 3G network and disallow non-VoLTE handsets run on its network as early as January 2021.

The NPD Take:

- AT&T’s (and T-Mobile’s alleged) new plans of limiting non-VoLTE-capable unlocked phones’ access to its network is alarming for the unlocked smartphone market, which is busy preparing for a 5G wave that will cripple its potential. NPD’s latest Unlocked Smartphone Demand Report estimates the total size of this market to be at 50 million units, and AT&T and T-Mobile, are the top two network facilitators for unlocked smartphones.

- This move will challenge the unlocked OEMs who are not obtaining network compatibility certifications from carriers. Considering the high cost of this process, it is safe to assume that the unlocked market will go through a consolidation period where many of the tier-3 brands shipping directly from overseas will disappear from the radars of U.S. consumers.

Cricket Wireless updates rate plans

Cricket Wireless last week announced the update of two its rate plans. The prepaid carrier’s popular $40 plan, which previously offered 5GB of high speed (8 Mbps) data, has now doubled in bucket size (10 GB). Customers will see their data speeds drop down to 2G levels (around 120 Kbps) once they reach their 10 GB allowance. Cricket also updated its top-tier $55 unlimited rate plan, which previously offered downlink speeds at 3 Mbps. The updated plan now offers customers downlink speeds of 8 Mbps, though customers will continue to experience low speeds as they will be deprioritized at times of network congestions.

The NPD Take:

- We previously predicted during our COVID-19 impact presentations that prepaid carriers’ participation in the Keep Americans Connected pledge in the form of boosting data bucket sizes will result in an expansion of data bucket sizes as well as in a shift in plan upgrades to unlimited options as a result of changing user behavior that demands more data. Cricket’s decision to boost the bucket size of its popular $40 plan was a necessary move as NPD Connected Intelligence’s SmartMeter revealed that average cellular data consumption among prepaid consumers has risen above the 9 GB/month as of the end of Q2 2020.

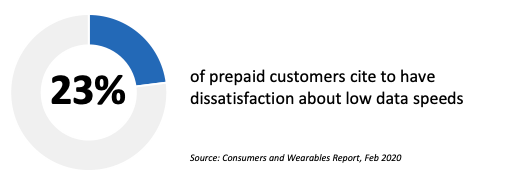

- The increase in downlink speeds in the $55 unlimited plan is a good move in the right direction as network speed (or lack of speed) is cited as one of the top three dissatisfaction reasons prepaid users cite regarding their wireless service.