Cable MVNOs report Q3 performance

Comcast and Charter last week announced the results of their Q3 2020 operations and, as in the previous quarter, both cable operators continued to shine in boosting their mobile subscriber bases. Charter’s Spectrum Mobile hit the 2 million subscribers mark adding 363K new mobile lines during the quarter. Comcast’s Xfinity Mobile, on the other hand, added 187K new subscribers and is now home to 2.6 million mobile lines. Both cable companies continued to have their mobile bottom lines in the red due to customer acquisition and MVNO wholesale costs.

The NPD Take:

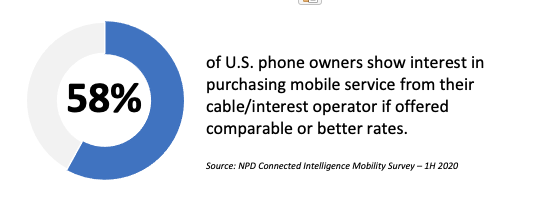

- Cable MVNOs have outshined the market during the pandemic period as their Achilles’ Heel, limited retail footprint, was leveled off due to mobile carriers’ retail store closures. Their pay-by-the-gigabyte service model has also proven to be quite attractive considering the heavy reliance on Wi-Fi coupled with consumers’ motivation to save money during the economic downturn. The two cable giants now account for close to 5 million mobile lines (which they mainly stole away from postpaid carriers) and their mobile bottom lines are poised to turn to black in parallel to the expansion of their subscriber base.

- While the aforementioned pandemic-driven dynamics that have helped Xfinity Mobile and Spectrum Mobile outperform competitors continue to be present, Q4 2020 subscriber growth may not as promising as both cable MVNOs have decided to go easy on their new iPhone promotions. Stepping on the subsidy brakes may slow down the growth, but it will have a positive impact on their bottom lines.

LG claims the 5G price leadership

LG announced the upcoming availability of the K92, its new entry-level 5G phone, at AT&T, Cricket Wireless, and USCellular. The phone will carry a $394 price tag at AT&T, “strategically” beating T-Mobile’s $399 price point on the TCL-made REVVL 5G. AT&T’s main prepaid arm, Cricket Wireless, will sell the phone for $359 beginning November 6. USCellular, on the other hand, will begin selling the phone on November 19. Incidentally, AT&T also announced that LG’s Wing flagship phone (which boasts a secondary swiveling display) will be available with up to a $700 discount ($11.67/monthly payments for 30 months) for new and existing subscribers on November 6. The phone, which has a three-week exclusivity period with Verizon, will also be available through T-Mobile. T-Mobile will offer the phone with a Buy-One-Get-One-Free with no trade-in requirement.

The NPD Take:

- AT&T and LG’s 5G price leadership on the new K92 will likely be short-lived as we expect 5G device MSRPs to continue to fall in the coming weeks and months. With Qualcomm’s new low-end 5G chipsets hitting the market in early 2021, it will not be surpsing to see 5G device MSRPs go down to sub-$200 levels. Meanwhile, low-end 5G smartphones like the LG K92 will be subject to various free device offers to attract switchers from rival carriers during the busy holiday season.

Verizon adds TCL to its lineup

TCL has been a veteran of the U.S. mobile device landscape as the maker of the Alcatel, BlackBerry, and Palm device brands. The company’s Alcatel business has been especially successful as it has helped almost all of the major US carriers build a competitive low-end device lineup and put price pressure on the more established OEM partners such as Samsung and LG. TCL last year changed course by announcing intentions to market phones under the TCL brand name and launched a set of new phones, including the TCL 10 5G that commercially debuted in the US as an unlocked device. The OEM last week announced that a custom mmWave version of the TCL 10 5G is now available through Verizon Wireless. The new phone, dubbed the TCL 10 5G UW, carries a $399 price tag making it the lowest priced 5G device available at Verizon.

The NPD Take:

- TCL’s strong brand and market positioning in the TV space can assist the brand in the selling of the new 5G phone through Verizon’s national distributors such as Best Buy and Walmart, though the majority of the sales will likely come from the carrier’s direct channels as it will be subject to aggressive “free” switcher or upgrade offers.