T-Mobile hits the 100 million mark

The Un-carrier T-Mobile last week announced the results of its Q3 2020 operations, and it once again did not disappoint. The carrier has added a record 1.98 million new postpaid subscribers, 689K of which were postpaid phone additions. The carrier ended the quarter with a total of 100.4 million connections. The carrier’s prepaid business also grew, but only by a small margin (up by 56K new connections) compared to the postpaid side. T-Mobile also announced that it has sold 4.2 million mobile broadband and IoT devices in 2020, and 2.2 million of these were sold in Q3 2020. The carrier’s non-phone postpaid base has gone up by 1.3 million new lines, reaching 12.9 million connections. T-Mobile’s postpaid churn, which had previously hit a record low 0.8% in Q2 2020, has gone up slightly to 0.9% during the third quarter. Prepaid churn, on the other hand, changed little from Q2 (2.81%) to Q3 (2.86%).

The NPD Take:

- T-Mobile’s stellar performance in attracting close to 700K new postpaid phone subscribers in Q3 2020 is a significant sign of pandemic trend reversal. The carrier added an average of 780K new phone lines every quarter in 2019 and had then seen this figure drop by more than half to 353K new phone subscribers during the first two quarters of 2020. It will be interesting to see if T-Mobile will be able to maintain the same momentum during the busy holiday shopping quarter. The expected store closures during the winter months coupled with AT&T’s unexpected move to extend switcher iPhone promotions to its large base of upgraders will likely limit T-Mobile’s ability to hit the one million new postpaid phone connection mark in Q4 2020.

- T-Mobile’s record sales (and lease) of mobile broadband and IoT products signals to the increase in demand for mobile hotspot and connected tablet/PC devices, though it is important to highlight that T-Mobile rounds out the bottom in connected tablets with an estimated 5 million active lines. Rivals Verizon and AT&T, on the other hand, enjoy the lion’s share (with an estimated 12.6 million and 7.9 million connected tablets, respectively) thanks to their larger enterprise bases.

Dish is off to a rocky start

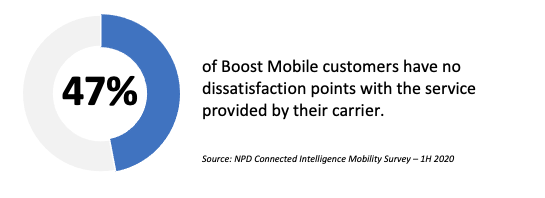

Last week was a memorable one for Boost Mobile as its new owner Dish Network released its first quarterly operational results including the Boost Mobile prepaid business. The company announced that it lost 212K subscribers, to end the quarter with 9.42 million subscribers. Dish currently runs its operations as a wholesale MVNO on the T-Mobile network and is on the hook (enforced by the FCC) to deploy a wireless network covering 20% of the U.S. population by June 2022 and 70% of the population by June 2023. Dish holds a substantial amount of wireless spectrum and had a preliminary plan of launching a cloud-based OpenRAN 5G network by the end of 2020 on its spectrum. Dish announced that it has postponed this plan to later time in Q1 2021 and that it will not have a major network operation until the second half of 2021.

The NPD Take:

- In July we reported on Dish Network’s much-speculated acquisition of Sprint’s Boost Mobile prepaid assets (and $3.6 billion worth of low-band spectrum from Sprint) and discussed its difficult task of adhering to its network build-out commitment while trying to maintain (and grow) the ultra-elusive prepaid base it has inherited from Sprint. As we expected, Boost Mobile had become one of the few wireless carriers to take a hit in subscribers in Q3 2020 due to heavy promotional campaigns from prepaid rivals (including network partner T-Mobile).

- Similarly, two weeks ago we reported on Dish’s new 2GB - $10/Month rate plan campaign and commented that these aggressive promotions signaled to Dish’s eagerness (and desperateness) to bring in new customers at a time when both prepaid and postpaid carriers are enjoying record-low churn rates. Q4 2020 is expected to be a busy season for wireless customer churn, and if Boost is not able to attract enough new customers to offset the upcoming churn, the low-ARPU business model will limit its ability and motivation to move ahead with its 5G network deployments.